What Is Available Balance vs Current Balance?

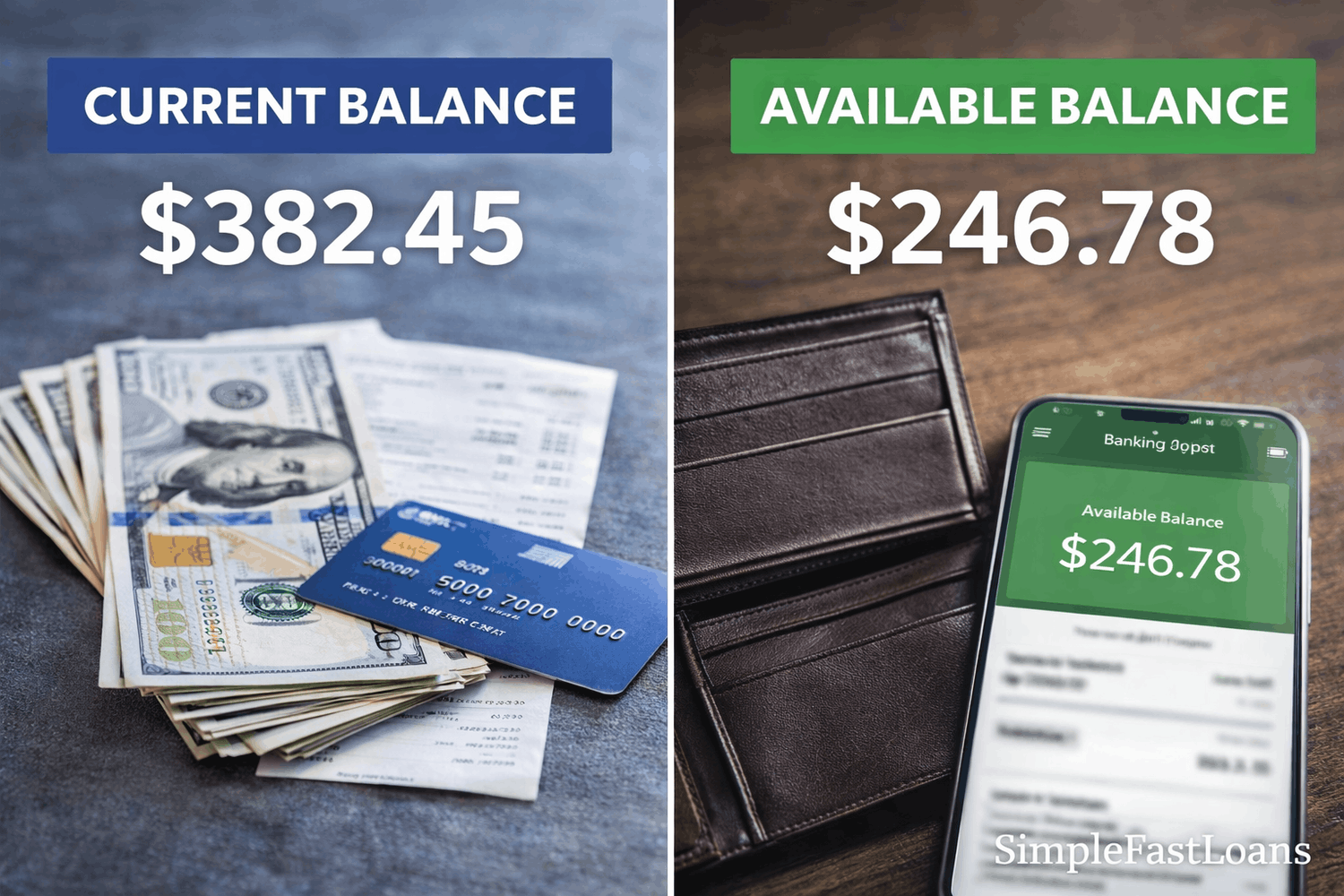

When logging into a banking app, account holders often encounter two distinct numbers: current balance and available balance. This seemingly minor distinction carries significant financial consequences. Confusion between these figures has led countless consumers to face declined transactions, insufficient funds fees, and disrupted payment schedules, all while believing sufficient money existed in their accounts.

Understanding the difference between these balance types directly impacts financial stability, particularly for individuals managing recurring bills, loan payments, and daily expenses. The distinction becomes especially critical when automated payments attempt to process, as banks rely exclusively on one of these numbers to authorize or decline transactions.

Key Takeaways

- Current balance shows total funds held in an account after posted transactions, while available balance reveals the actual spendable amount after accounting for pending transactions, holds, and restrictions.

- Banks authorize or decline all transactions—including automatic loan payments, bill payments, and purchases—based exclusively on available balance, not current balance.

- Relying on the current balance instead of the available balance causes most non-sufficient funds (NSF) fees, declined payments, late fees, and potential credit score damage from failed automatic payments.

- Monitoring available balance daily, maintaining a protective buffer above scheduled payments, and aligning deposit timing with payment dates prevent costly declines and ensure successful loan repayment.

Current Balance vs Available Balance

Current balance represents the total funds in an account after all posted transactions have cleared. This figure includes completed deposits, processed withdrawals, and finalized purchases that the bank has officially recorded. Current balance reflects the actual dollar amount the financial institution holds in the account at that specific moment, providing a historical snapshot of funds on record.

Available balance indicates the spendable funds accessible for immediate use. This amount equals the current balance minus pending transactions, deposit holds, and reserved funds. Available balance shows precisely how much money can be withdrawn, spent, or transferred right now without triggering declined transactions or insufficient fund situations.

In short, current balance reports what exists in the account, while the available balance reveals what can actually be used. Banks authorize or decline transactions based exclusively on available balance, making it the definitive measure for spending decisions, bill payments, and withdrawal planning.

Several factors create gaps between these two numbers:

- Pending transactions reduce available balance immediately upon authorization but don't affect the current balance until they officially post, typically one to three business days later.

- Deposit holds allow recently deposited checks to appear in the current balance while restricting access in available balance until the funds verify and clear, often requiring 24 to 48 hours or longer.

- Merchant authorization holds temporarily reserve amounts in the available balance that exceed actual purchase costs until final charges are processed; common at gas stations, hotels, and car rental locations

- Check clearance periods decrease the available balance when checks are presented for payment, though they may take additional time before appearing as posted transactions in the current balance.

Understanding both balance types prevents a common and costly mistake: seeing an adequate current balance and assuming sufficient funds exist for purchases or payments, only to face declines because the available balance sits substantially lower due to pending activities and holds.

Key Distinctions Between Balance Types

The differences between these balance types create practical implications for financial management:

- Transaction inclusion: The current balance reflects only posted transactions that have completed processing. The available balance accounts for both posted transactions and pending activities that have received authorization but have not yet cleared.

- Spending authority: Financial institutions use the available balance as the authoritative figure when approving or declining transactions. The current balance plays no role in these real-time decisions.

- Deposit accessibility: A recently deposited check might immediately increase the current balance by its full amount while only incrementally increasing the available balance as the hold releases.

- Account monitoring: Checking the current balance alone provides an incomplete and potentially misleading understanding of accessible funds, whereas the available balance offers an accurate snapshot of usable money.

The Connection Between Balance Types and NSF Fees

Non-sufficient funds (NSF) fees occur when a transaction attempts to process, but an insufficient available balance exists to cover it. Banks typically charge $25 to $35 per declined transaction, with some institutions assessing multiple NSF fees in a single day if several transactions fail.

The distinction between NSF situations and overdrafts causes additional confusion:

- NSF scenarios: The bank declines the transaction entirely due to inadequate available funds. The merchant or service provider does not receive payment, and the account holder faces an NSF fee while the original bill remains unpaid.

- Overdraft situations: The bank approves the transaction despite insufficient available funds, creating a negative balance. The account holder incurs an overdraft fee, typically matching or exceeding NSF fee amounts, and must deposit funds to restore a positive balance.

Many consumers fall into NSF situations precisely because they monitor their current balance rather than their available balance. An account might show a comfortable current balance of $400, creating a false sense of security. However, if pending transactions have reduced the available balance to $150, a $200 bill payment will trigger an NSF decline despite the apparently adequate current balance.

Real-World Balance Mismatch Scenarios

Consider a common sequence of events that demonstrates how balance confusion creates financial problems:

An account holder checks their account on Monday morning and sees a current balance of $500. Feeling confident about available funds, they write a $450 check for rent. However, the current balance includes a $200 paycheck deposited on Friday afternoon that remains under a pending direct deposit, making only $100 immediately available.

Additionally, three debit card purchases from the weekend—totaling $150—have received authorization but not yet posted to the current balance. The actual available balance stands at only $250 ($500 current balance minus $200 hold minus $50 pending transactions).

When the rent check presents for payment on Tuesday, the bank faces a choice: decline the check and assess an NSF fee, or honor the payment and charge an overdraft fee. Either outcome creates unnecessary costs stemming directly from the account holder's reliance on the current balance rather than the available balance.

Available Balance Impact on Recurring Payments

The relationship between available balance and automated payments carries particular significance for financial stability. Many essential services—utilities, insurance premiums, phone bills, and loan installments—rely on scheduled automatic debits from checking accounts.

Banks process these recurring payments by checking the available balance at the moment the transaction attempts to clear. Even if a payment has successfully processed for months, a single instance of insufficient available balance can trigger a decline. The consequences extend beyond immediate NSF fees:

- Late payment fees: The original creditor or service provider typically assesses late fees ranging from $25 to $40 when automatic payments fail.

- Service interruptions: Utility companies and subscription services may suspend access following declined payments.

- Credit score damage: Loan payments reported late to credit bureaus can reduce credit scores by 50 to 100 points, with the negative mark remaining for seven years and harming your overall payment history.

- Relationship strain: Repeated payment failures may lead lenders to revoke automatic payment options, requiring manual payments and increasing the risk of future late payments.

Strategies to Prevent NSF Declines and Payment Failures

Effective available balance management requires systematic approaches rather than occasional checking:

Establish Daily Monitoring Habits

Checking available balance—not current balance—should become as routine as checking the weather before leaving home. Most banking apps display available balance prominently, and many allow users to set it as the default view. This simple adjustment prevents the common mistake of relying on the less relevant current balance figure.

Implement Low-Balance Alerts

Nearly all banks offer customizable account alerts delivered via text message, email, or push notification. Setting alerts to trigger when the available balance drops below a threshold, such as $200 or an amount exceeding the largest regular payment, provides a warning of potential problems. These alerts create opportunities to transfer funds from savings, adjust spending, or contact creditors before payments fail.

Maintain a Protective Buffer

Financial advisors commonly recommend maintaining a minimum account balance above zero, but this guidance proves insufficient when dealing with the available balance. A more effective approach involves establishing a buffer amount that exceeds the largest regular payment. If the largest monthly obligation totals $500, maintaining an available balance above $600 provides cushioning against unexpected holds or pending transactions.

Create a Payment Calendar

A simple calendar marking all scheduled automatic payments, typical paycheck deposits, and known upcoming expenses transforms available balance management from reactive to proactive. This tool reveals potential problem periods when multiple payments cluster before deposit arrivals, allowing time to adjust payment dates or ensure an adequate available balance.

Evaluate Overdraft Protection Options

Banks offer several overdraft protection variations, each with distinct implications, often tied to how the bank processes ACH transfers:

Linked savings transfer: The bank automatically transfers funds from a savings account to cover shortfalls in checking. This option typically incurs a modest transfer fee ($10-$12) rather than a full NSF or overdraft fee, but it requires maintaining an adequate savings balance.

Line of credit: Some institutions offer overdraft lines of credit that advance funds when the checking account's available balance proves insufficient. Interest charges apply, but they often cost less than NSF fees for small, briefly overdrawn amounts.

Extended overdraft coverage: Rather than declining transactions when the available balance falls short, the bank approves them and assesses overdraft fees. While this prevents service interruptions from declined payments, the fees accumulate quickly with multiple transactions.

Each option involves costs, making them less than ideal solutions. However, in situations where payment failure would cause greater damage—such as a critical loan payment that affects credit scores—overdraft protection serves as a safety net.

For situations where timing mismatches between deposits and scheduled payments create ongoing stress, some consumers choose structured repayment options that align better with predictable monthly budgeting. Installment loans spread repayment over fixed intervals, making it easier to plan around available balance fluctuations and reduce the risk of missed payments caused by temporary holds or pending transactions.

Common Misconceptions About Account Balances

Several persistent myths about account balances continue causing financial problems:

Myth: Current balance indicates spendable money. The current balance reflects total holdings but not spending authority. This widespread misconception directly causes many NSF situations. Banks use available balance exclusively when authorizing transactions, making the current balance relevant only for general account tracking, not spending decisions.

Myth: Online banking always displays real-time balances. While online and mobile banking update frequently—often multiple times daily—they still reflect information processed by the bank's systems. Transactions authorized just moments ago may not yet appear in either balance, creating a lag between actual financial position and displayed figures. This lag demands conservative spending that accounts for very recent transactions not yet reflected in the available balance.

Myth: Pending transactions always clear within 24 hours. Debit card authorizations typically remain pending for one to three business days, but variations occur widely. Merchants sometimes delay submitting finalized charges, and banking holidays extend processing times. Weekend transactions, in particular, may not post until the following Tuesday or Wednesday, creating longer periods of reduced available balance.

Myth: Deposit holds only affect large or suspicious deposits. Federal banking regulations allow banks to place holds on various deposits, regardless of amount, including local checks, out-of-state checks, and mobile deposits. First-time depositors, new accounts, and accounts with previous overdrafts face extended holds even for routine deposits. These holds reduce the available balance while the current balance may show the full deposit immediately.

Account holders who master this distinction position themselves to avoid preventable fees, maintain stronger credit scores through consistent on-time payments, and experience less financial stress from unexpected declines or insufficient funds situations. The path to this improved financial position starts with a simple commitment: always check the available balance, never assume the current balance tells the complete story.

Related Frequently Asked Questions (FAQs)

Here are questions people often ask about current balance vs available balance:

Why does the available balance sometimes exceed the current balance?

This unusual situation occurs when account holders have overdraft protection and have used it. The current balance shows a negative figure representing the overdraft amount, while the available balance reflects remaining overdraft credit. For example, an account with $500 overdraft protection that's overdrawn by $50 shows a -$50 current balance but a $450 available balance.

Can the available balance change without any account activity?

Yes, when pending transactions expire or are released. If a gas station places a $100 hold for a $40 purchase, the hold reduces the available balance by $100 initially. When the actual $40 charge posts days later, the remaining $60 hold releases, increasing the available balance by that amount without new deposits or withdrawals.

Do all banks calculate these balances identically?

While basic principles remain consistent across institutions, specific policies vary regarding hold durations, pending transaction display, and overdraft calculations. Reviewing a specific bank's disclosure documents clarifies exactly how they determine both balance types.

Should savings accounts receive the same monitoring attention?

Savings accounts generally experience fewer balance complications since they rarely involve pending debit card transactions or check clearing. However, savings accounts used for overdraft protection or automated transfers to checking still require monitoring to ensure adequate available funds exist when needed.