Consumer Disclosures

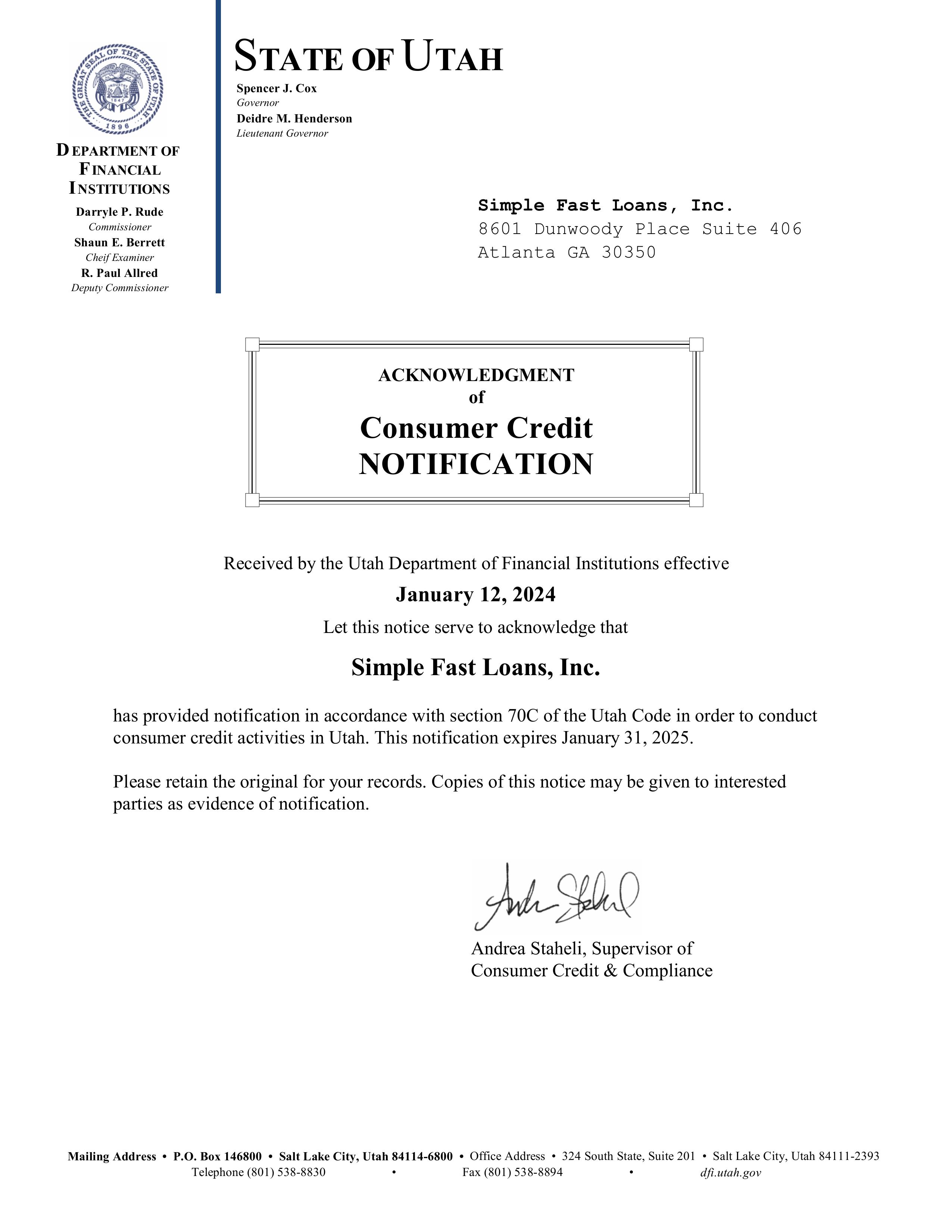

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Installment high interest loans should be used for short-term financial needs only and not as a long-term financial solution; and customers with credit difficulties should seek credit counseling before entering into any installment loan transaction.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

The Ohio laws against discrimination require that all creditors make credit equally available to all credit worthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio civil rights commission administers compliance with this law.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

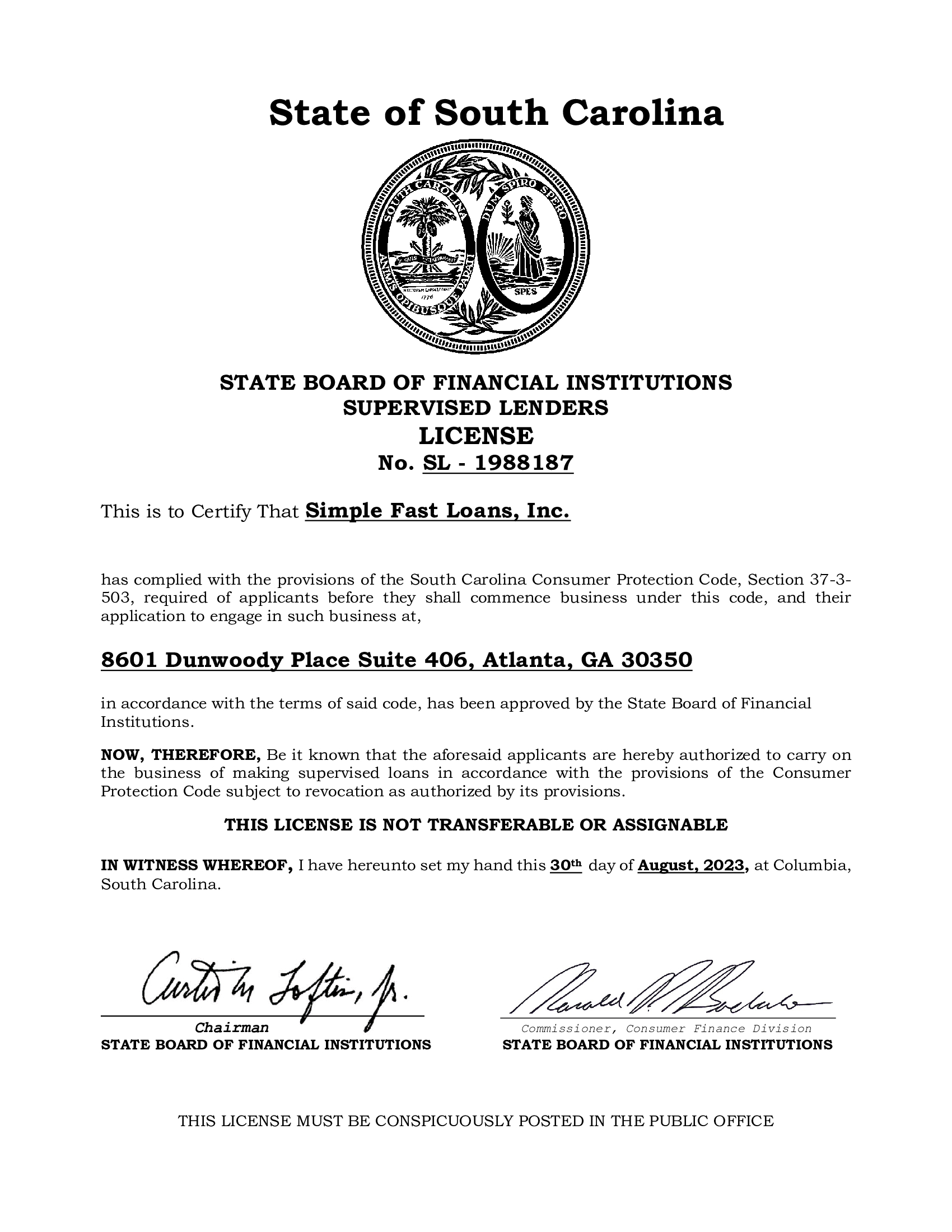

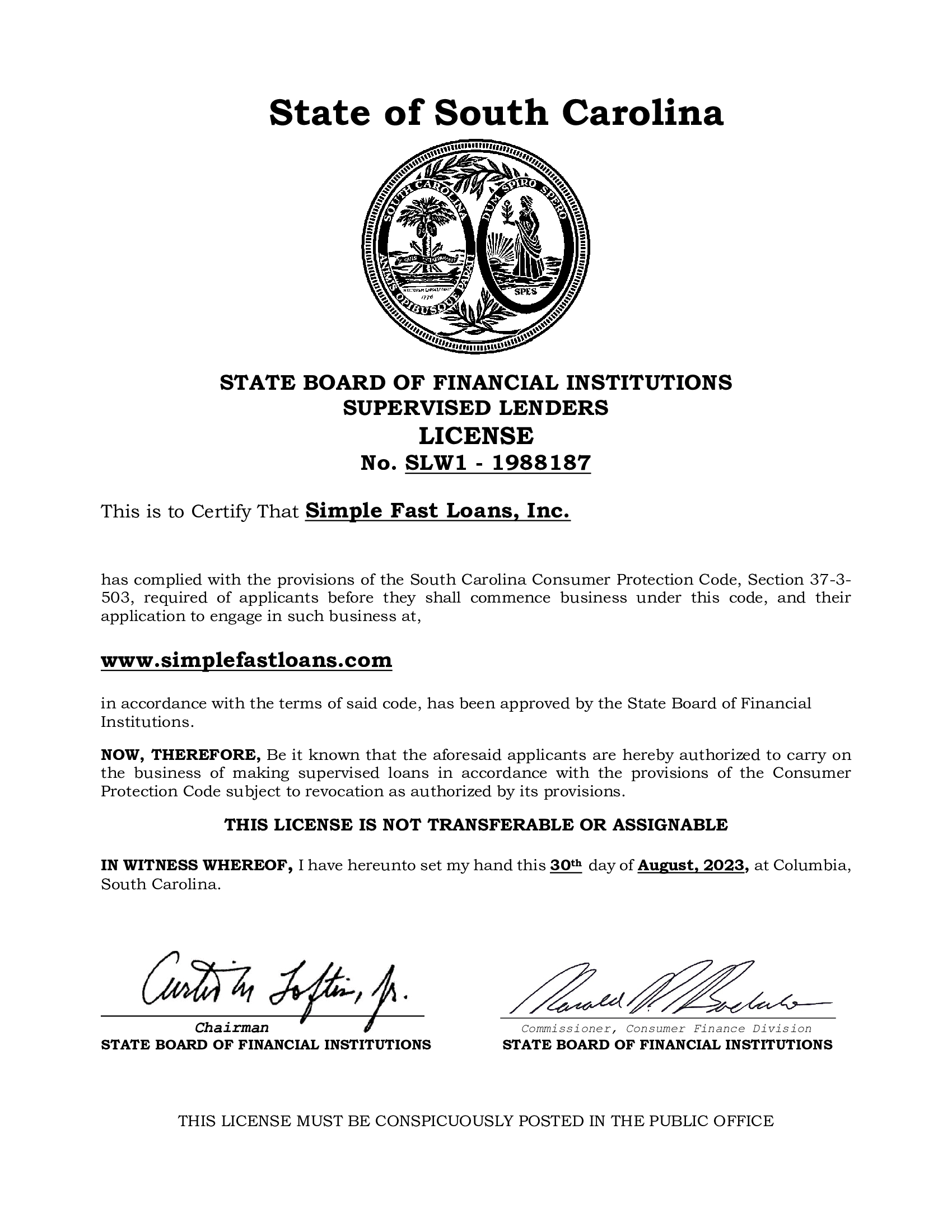

Supervised Lender License

(Simple Fast Loans, Inc.)

Supervised Lender License

(Simplefastloans.com)

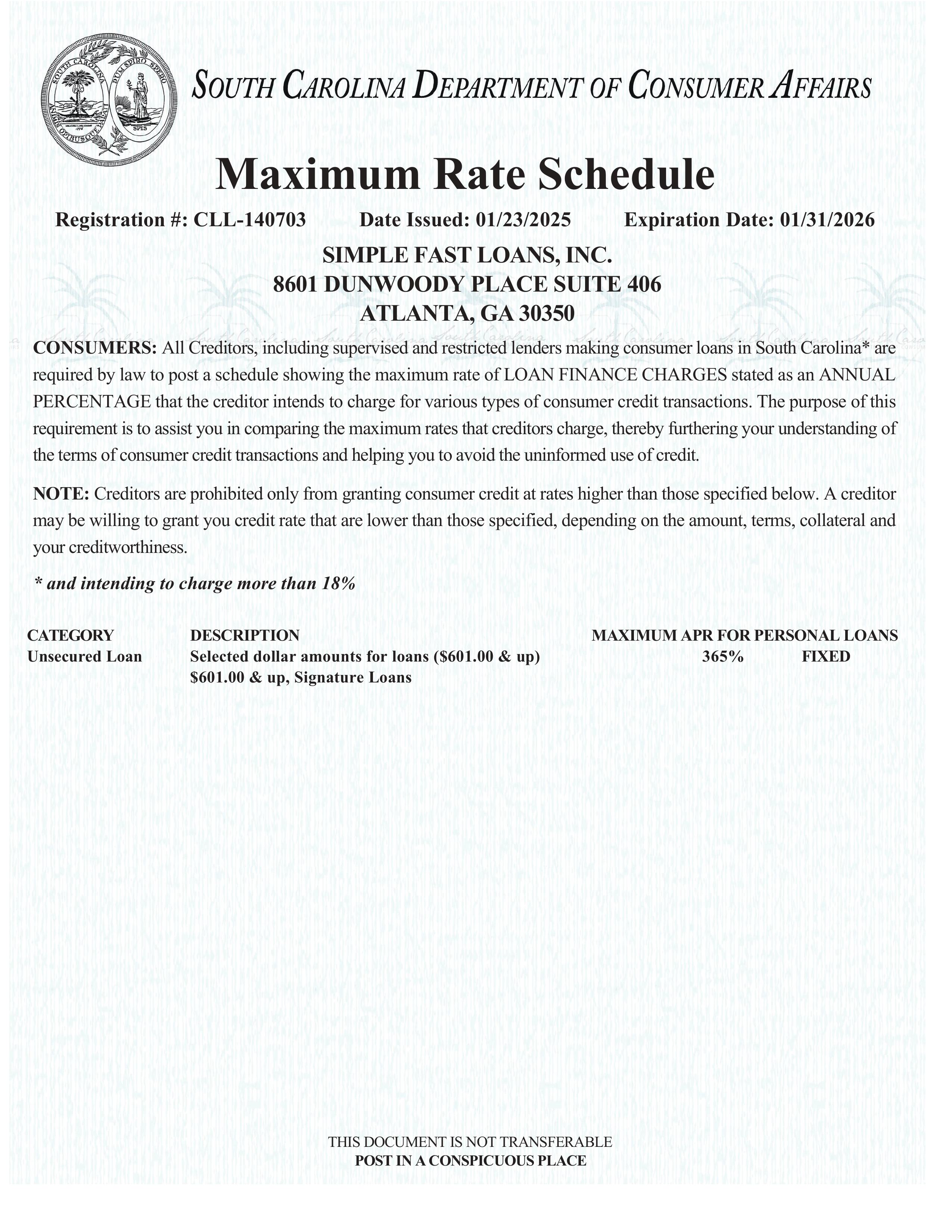

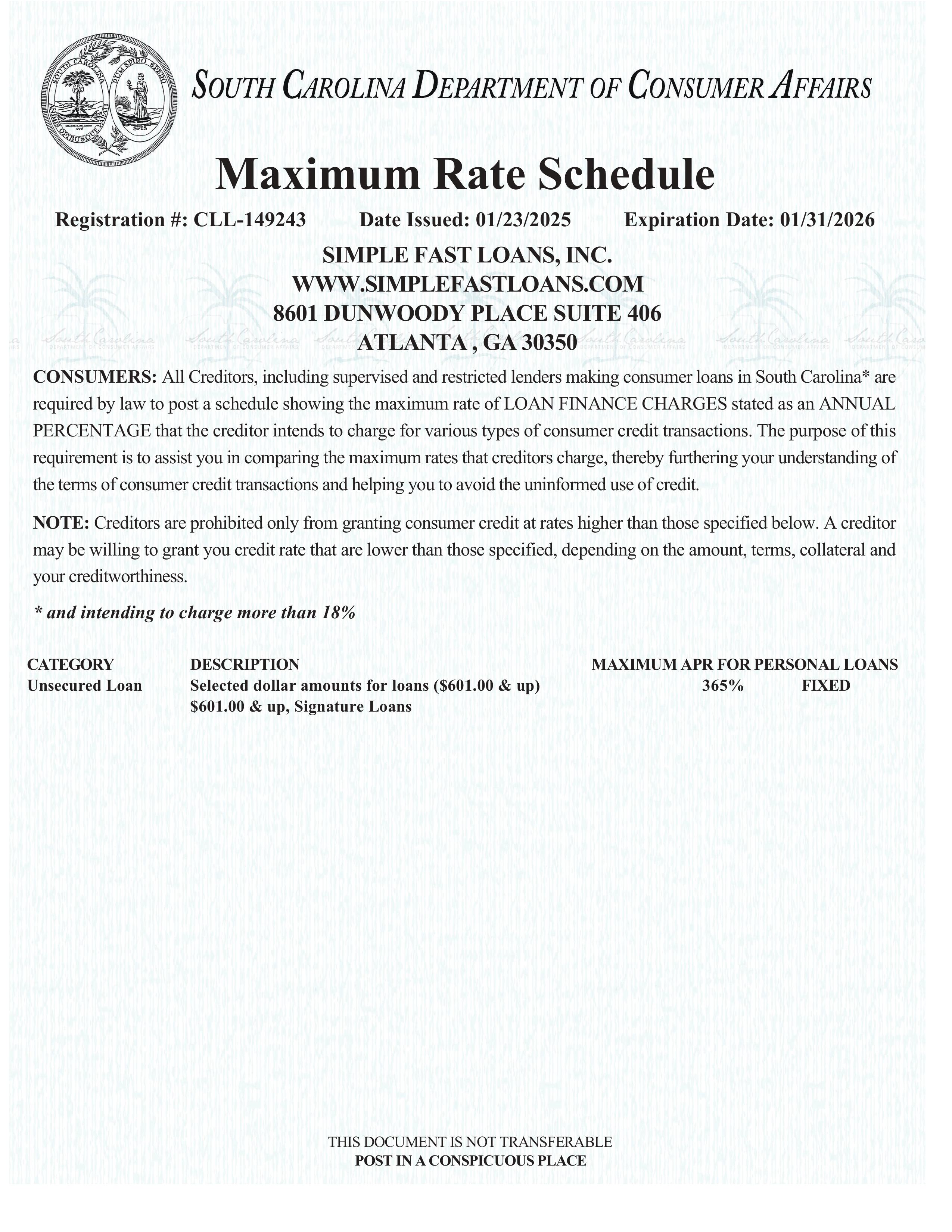

SC Max Rate Schedule

(Simple Fast Loans, Inc.)

SC Max Rate Schedule

(Simplefastloans.com)

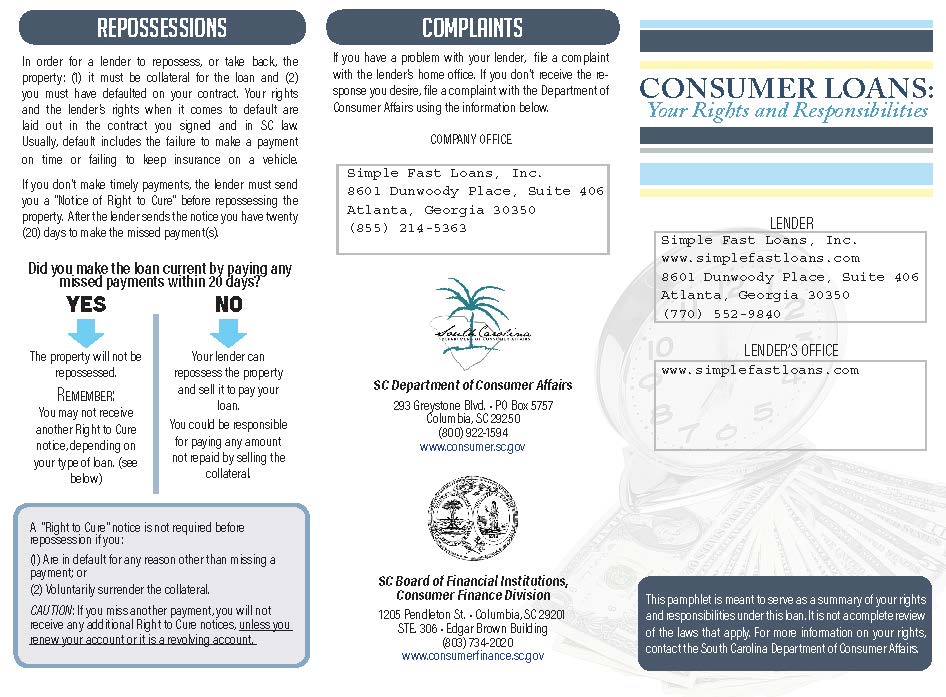

Consumer Rights

Pamphlet

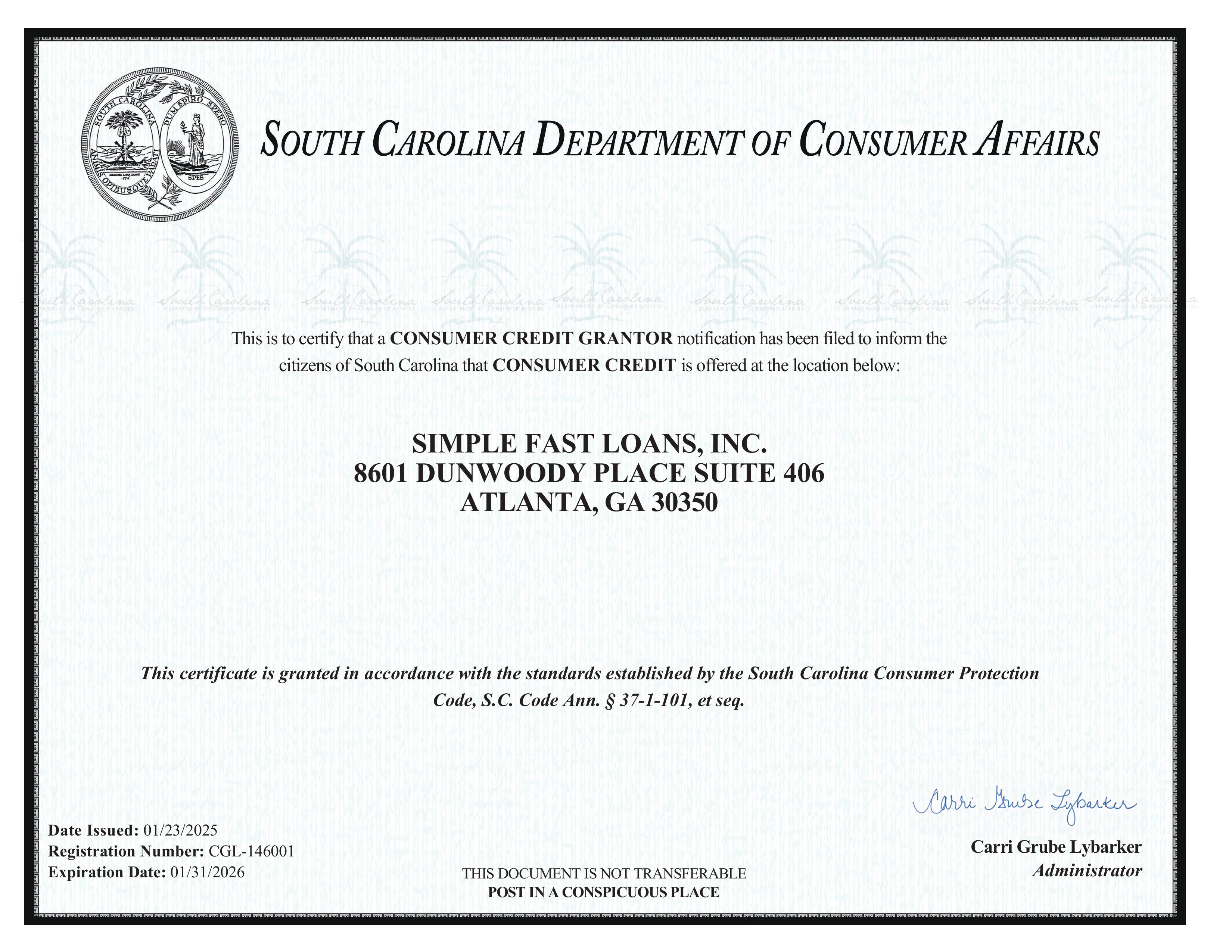

Consumer Credit

Grantor Notice

(Simple Fast Loans, Inc.)

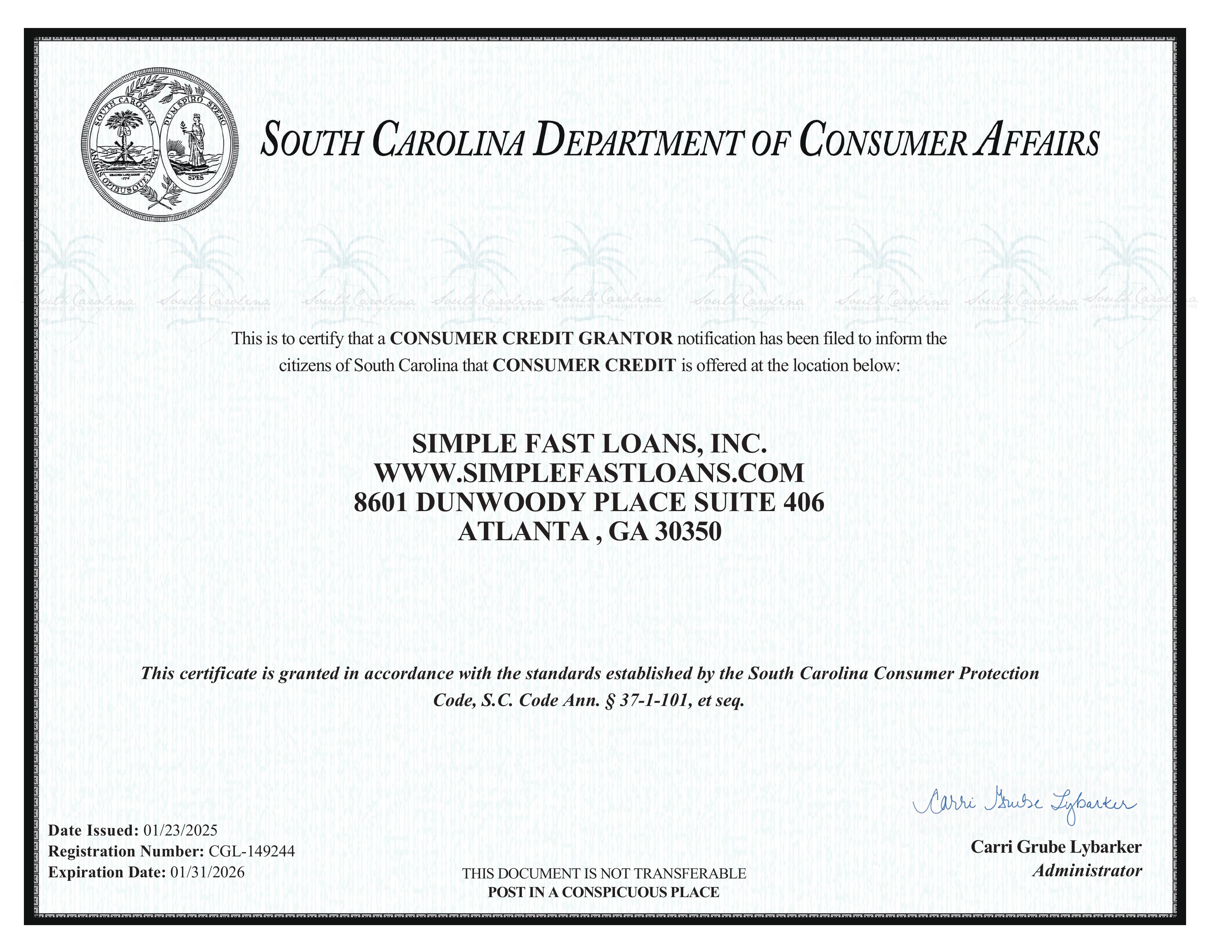

Consumer Credit

Grantor Notice

(Simplefastloans.com)

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Loans provided by CC Connect, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah. Loans funded by CC Connect will be serviced by Simple Fast Loans. CC Connect maintains the critical control of the Simple Fast Loans loan origination, underwriting approvals, regulatory, and compliance oversight management. Simple Fast Loans is an authorized servicer of CC Connect. This means you will maintain your CC Connect loan account through Simple Fast Loans.

Where applicable, Simple Fast Loans undertakes all collection activity in strict compliance with the provisions of the Federal Fair Debt Collection Practices Act enforced by the Consumer Financial Protection Bureau and other Federal Agencies. While Simple Fast Loans does not operate as a third party debt collector, our companies adhere to all relevant laws, rules, and regulations. Applicable provisions of the Fair Debt Collection Practices Act prohibit the following:

- Contacting consumers by telephone before 8 a.m. or after 9 p.m.

- Contacting consumers by phone with the intent to annoy, harass, etc., or using abusive language at anytime.

- Collecting debt through deception or misrepresentation.

- Threatening legal recourse when no legal action is intended.

By opting in to receive SMS text messages, you authorize Simple Fast Loans (“we” or “us”) with express consent to send you text messages about your loan, such as payment reminders. You may also opt in to receive marketing messages about other services we offer, including special offers for which you may be eligible. In doing so, you agree and expressly consent to be contacted by us, our agents, employees, and/or affiliates through the use telephone calls and/or SMS text messages to any cellular number you provide in conjunction with your account, including contacts through the use of automatic telephone dialing systems, autodialers, or an artificial or prerecorded voice.

Your cellular provider's message and data rates may apply to our SMS messages.

Data obtained from you in connection with this SMS service may include your name, address, cell phone number, your provider's name, the date and time, and content of your messages. Data we provide to you may include account information, payment amount or due dates, and other information personal to you. Some of the text messages we send may include links to websites. To access these websites, you will need a web browser and Internet access on your cellular device. Downloadable content may incur additional charges from your wireless carrier. Please contact your wireless carrier for information about your messaging plan. We will not be liable for any delays in the receipt of any SMS messages, as delivery is subject to effective transmission from your network operator.

Opting-Out to Stop Text Messaging

If you wish to stop receiving text messages from us, type STOP in the reply text you send us or, if available, access any opt-out link at the bottom of the text message. Your stop request will become effective within one day.

SMS Help or Support

For help or additional information regarding our texting services email us at customerservice@simplefastloans.com, call us at 866-521-1445, or reply "HELP"to the message you receive at any time from your mobile device.