Frequently Asked Questions

The Loan Process

What does it mean that I'm pre-approved, pre-selected or pre-qualified?

This means you were selected for the offer based on information in your credit report that satisfied our criteria for creditworthiness. Certain events or changes to your information may impact your eligibility. The offer may not be guaranteed if you do not continue to meet pre-established criteria used to select you for the offer.

Can I apply over the phone?

We require all loan applications to be processed online at simplefastloans.com. However, if you are having trouble with the online application process, we are happy to help you through it! It's easy.

How quickly can I get my loan funded? When will funds hit my account?

Loans signed before 2:00 PM ET on a bank day are typically funded the same day. Loans signed after 2:00 PM ET will be funded by the end of the next bank day. There is also has an option to get instant funding using your Visa or Mastercard branded bank debit card. To explore instant funding, process your online application, then Contact Us to check the eligibility of your card for instant funding.

Why do I have to give you my online banking information?

In some instances, an online Instant Bank Verification service (Plaid or Decision Logic) will be used to verify your banking information. This done for your security to ensure that the banking information that has been provided belongs to the applicant. When you provide your online banking credentials to release a bank statement, you are providing this information securely and confidentially to the Instant Bank Verification service, not Simple Fast Loans.

I'm paid on a prepaid card, will that work?

An active checking account is required to process your loan application.

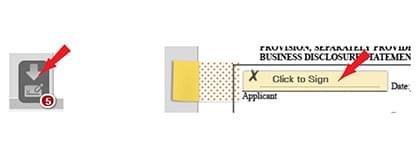

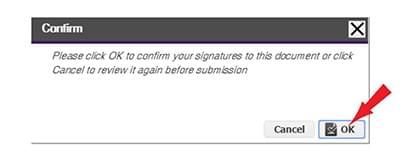

How does the e-sign process work?

After your loan agreement has been setup, you will be presented with a loan package online to e-sign. This can happen either on the simplefastloans.com web site directly, or separately through e-mail where we will e-mail you a link to enter the e-sign process. To e-sign, you will need to follow the instructions on the screen and click each spot on the loan agreement where a signature or initial is required. Guides on the left of the screen make it easy to navigate to the next e-sign block to click. Instructions for e-signing your loan documents can be found below.

I signed my loan agreement, now what?

You are done! After you sign your loan agreement, there will be some pre-funding processing, then your loan will be funded. You will get a text when your signed loan agreement received, then again after your loan is funded.

When or can I be eligible for additional funds on a current loan?

After a series of on-time payments and the reduction of your loan balance, you will be eligible for an increase. We will e-mail you when you become eligible and you can process a loan increase easily online.

Why did I get this letter in the mail and/or how did you get my information?

Your information was obtained during a prescreen process from one of the 3 credit bureaus. This means that you satisfied certain criteria for creditworthiness. You can choose to stop receiving 'prescreened' offers of credit by calling the toll-free numbers in the prescreen & opt-out notice section of your solicitation letter.

Account Management

How can I see my account balance?

Once you have a loan activated, you can access your account balance and perform account functions by selecting My Account.

How can I make a payment on my account?

Most loans are setup with automated recurring payments. However, you can make extra payments or payoff your account by selecting My Account. You can also Contact Us by phone to process a payment over-the-phone.

Where do I find my account number?

Your account number can be found at the top of your loan agreement. It will look something like SL-TX1234-200101-1234-00.

Do you store my personal information?

The information that we collect from your online loan application is stored securely and confidentially using all that security technology has to offer. Simple Fast Loans undergoes third party security audits on a regular basis to ensure that the data we have is safe and secure.

Loan Payments

Are there penalties for paying off early?

No! There are no extra charges for paying off early.

What if I don’t have funds in my bank account to make my scheduled payment?

If you cannot make your payment, know that we’re here to help. Contact Us at least 48 hours prior to your scheduled payment via phone or email to discuss payment arrangement options.

What is an EFT payment?

EFT is short for Electronic Funds Transfer and allows you to make your payment electronically. When the lender presents an EFT request to your bank for a scheduled payment, it will send the scheduled amount to the lender that was outlined in your loan agreement. EFT payments are the best way to make your scheduled payments when due. You only need to be sure that you have available funds in your account when the payment is due.

We Make Online Installment Loans Simple & Fast

1

1Simple Verification Process

2

2Instant Loan decisions*

3

3