When to Use a Money Order vs. a Cashier's Check

When it comes to secure payment methods beyond cash and standard checks, money orders and cashier’s checks are two of the most trusted financial instruments. Both are used for making guaranteed payments and are often required when personal checks won’t cut it. But while they share similarities, they serve different purposes and have important distinctions that every consumer should understand, especially in situations involving large sums of money or critical transactions.

Key Takeaways

- Money orders are ideal for smaller payments (typically under $1,000) and don’t require a bank account, making them accessible and budget-friendly. Cashier’s checks are preferred for high-value or critical transactions like real estate, due to their stronger bank-backed security.

- You can purchase money orders at post offices, retailers, and banks for as little as $1–$5, using cash or debit cards. They're best for rent, utility bills, and everyday private transactions—especially for the unbanked or underbanked.

- Issued only by banks and drawn from the bank’s own funds, cashier’s checks offer greater legitimacy, faster processing, and higher security, but come with higher fees ($10–$20) and require a bank account.

- Use a money order for low-cost, secure payments without sharing bank details. Opt for a cashier’s check when making large, high-stakes payments where guaranteed funds are essential and fraud prevention is a priority.

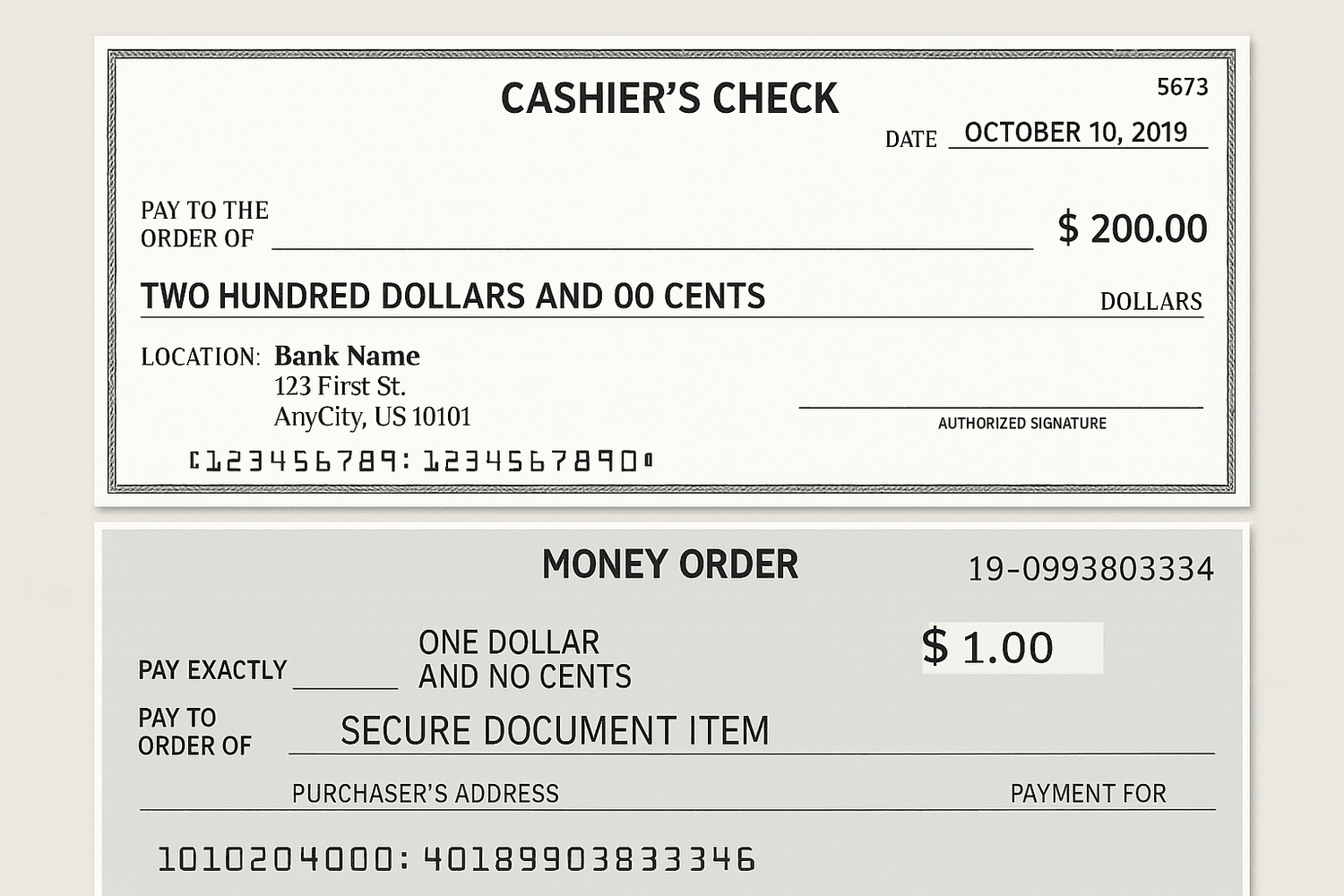

What Is a Money Order?

A money order is a prepaid financial instrument issued by a third-party institution (such as a bank, post office, or retailer) that allows the recipient to receive a specified amount of money. It's ideal for smaller payments where cash is unsafe or checks are not accepted.

If you are curious, money orders were first introduced in Great Britain in the 18th century, later gaining traction in the U.S. when the United States Postal Service (USPS) introduced its own money order system in 1864. This gave Americans a reliable way to send money across long distances without the risks associated with mailing cash.

Today, money orders are still a vital tool for unbanked and underbanked individuals, offering a secure and traceable form of payment.

Key Features of a Money Order

- Purchase limit. Typically capped at $1,000 per money order (U.S. standard), though limits vary by issuer.

- Availability. Easily accessible at USPS, Western Union, MoneyGram, Walmart, pharmacies, and most banks or credit unions.

- Payment method. Paid for using cash, debit card, or traveler’s checks. Credit card purchases are often prohibited or treated as cash advances.

- Recipient name. Must be filled out at the time of purchase—this reduces the risk of theft or fraud.

- Traceability. Each money order comes with a receipt and tracking number, enabling you to verify if and when it was cashed.

Common Uses for a Money Order

- Rent or utility payments

- eBay, Craigslist, or private-party sales

- Paying bills without a checking account

- Sending funds internationally (especially via Western Union)

Downsides of a Money Order

- Low maximum limits. Most money orders have a cap of $1,000 per instrument. For larger transactions, you’ll need to purchase multiple money orders, which can be inconvenient and increase the risk of loss or error.

- Limited acceptance. Some businesses and institutions—especially for large or formal transactions—do not accept money orders, viewing them as less secure or informal compared to cashier’s checks.

- Vulnerability to fraud. While more secure than personal checks, money orders can still be forged, altered, or counterfeited, especially if not properly filled out. Blank or incomplete money orders are particularly vulnerable.

- Tracking and replacement can be tedious. If a money order is lost or stolen, getting a replacement involves a claim process, which can take several weeks and often includes a non-refundable service fee.

- Must be purchased in person. Most money orders cannot be bought online, and you typically need to visit a post office, bank, or retail location during business hours.

What Is a Cashier’s Check?

A cashier’s check is a check guaranteed by a bank, drawn against the bank’s own funds and signed by a teller or officer. It's used for larger or high-stakes payments where the payee needs strong assurance that funds are guaranteed.

Cashier’s checks have been used for over a century by financial institutions to guarantee funds for major transactions. They gained prominence in the early 20th century, especially in real estate and legal settlements, where large sums needed guaranteed delivery without delay or risk of default.

Unlike personal checks—which can bounce—a cashier’s check assures the recipient that funds are already secured and available.

Key Features of a Cashier's Check

- Purchase limit. No formal cap—commonly used for amounts over $1,000, and even well into six figures.

- Availability. Only issued by banks and credit unions, and usually require the customer to have an account.

- Payment method. Paid from your checking or savings account; funds are withdrawn immediately by the bank.

- Bank guarantee. The check is drawn on the bank’s own account, adding a layer of legitimacy and security.

- Security. Includes watermarks, signatures, and other features making it harder to forge than personal checks or money orders.

Common Uses for a Cashier's Check

- Home and vehicle purchases

- Tuition or legal settlements

- High-value deposits for leases or auctions

- Transactions where the payee demands guaranteed funds

- Side-by-Side Comparison

When to Use a Money Order

- You don’t have a checking account but need to make a secure payment.

- You’re sending money via mail and don’t want to risk mailing cash.

- The payment amount is under $1,000.

- You want an affordable alternative to checks.

- Pro Tip: Always fill in the recipient’s name and keep your receipt. This prevents fraud and allows you to track the payment if it's lost or stolen.

Downsides of a Cashier's Check

- Higher cost. Cashier’s checks generally come with a $10 to $20 fee, which is significantly higher than the cost of a money order. Some banks waive this fee, but only for premium account holders.

- Requires a bank account. You must be an account holder at a bank or credit union to request a cashier’s check. This excludes unbanked or underbanked individuals from access.

- Target for fraud. Due to their perceived trustworthiness, fraudulent cashier’s checks are common in scams, especially in online transactions. They can appear legitimate, but if they’re fake, you’ll be held responsible by your bank once the check is rejected.

- No absolute guarantee for recipients. While backed by a bank, cashier’s checks can still be subject to holds or delays if the recipient's bank flags the item for further review—particularly in the case of large amounts or suspicious transactions.

- Refund process may be complicated. If a cashier’s check is lost or stolen and not cashed, you’ll typically have to complete an indemnity bond and wait 30–90 days before the bank will reissue or refund the amount.

- May not be available immediately. Not all banks issue cashier’s checks on demand, and some require you to schedule an appointment or order them through online or mobile banking, which can delay your transaction.

Is a Cashier's Check the Same Thing as a Money Order?

Although similar, a money order is not the same as a cashier's check, as both have different features that vary depending on the following factors:

| Feature | Money Order | Cashier’s Check |

|---|---|---|

| Issuer | Retailers, post offices, banks | Banks or credit unions only |

| Backed By | Buyer’s prepaid funds | Bank’s own funds |

| Max Limit | ~$1,000 (varies by issuer) | Often no limit |

| Cost | $1–$5 (retail); $5–$10 (banks) | $10–$20+ (depends on institution) |

| Processing Speed | Slower; may take days to clear | Faster; treated like cleared funds |

| Security | Lower; more susceptible to fraud | High; more secure and traceable |

| Use Cases | Everyday secure payments | High-value, sensitive transactions |

Fees and Accessibility: A Cost vs. Convenience Breakdown

When deciding between a money order and a cashier’s check, cost and accessibility can significantly influence your choice—especially for consumers without access to traditional banking.

Money Order Fees and Access

-

Cost. Typically ranges from $1 to $5, depending on the provider.

-

USPS charges $1.75 for amounts up to $500, and $2.65 for amounts from $500.01 to $1,000.

-

Walmart and other retail locations often charge less than $1.

-

Banks may charge slightly more, in the range of $5 to $10.

-

-

No bank account required. Money orders are available to anyone, regardless of banking status.

-

ID requirements. Some providers may request identification, especially for international money orders or larger amounts.

-

Payment methods. Generally purchased using cash, debit cards, or traveler’s checks. Most providers do not accept credit cards for money orders.

Money orders are ideal for consumers who are unbanked or underbanked, or for anyone seeking a low-cost, secure way to make small payments without sharing bank account information.

Cashier’s Check Fees and Access

-

Cost. Typically $10 to $20, depending on the institution.

-

For example, Bank of America charges $15, Chase charges $10 (often waived for premium accounts), and Wells Fargo charges $10.

-

-

Requires a bank account. Cashier’s checks can only be obtained from a bank or credit union, and usually only by account holders.

-

Bank processing. The funds are withdrawn directly from your checking or savings account at the time of issuance.

-

Transaction speed. Considered as good as cleared funds, cashier’s checks are often available for immediate use, giving recipients confidence in the validity of the payment.

While more costly and less accessible than money orders, cashier’s checks provide the highest level of trust and legitimacy for large or high-stakes transactions.

When You Should Use a Money Order or a Cashier's Check

| Criteria | Money Order | Cashier’s Check |

|---|---|---|

| Cost | $1–$5 | $10–$20 |

| Requires Bank Account | No | Yes |

| Availability | Retailers, post offices, banks | Banks and credit unions only |

| Purchase Method | Cash, debit, traveler’s checks | Funds withdrawn from your bank account |

| Typical Use Cases | Rent, bills, small sales | Real estate, car purchases, legal deals |

Both money orders and cashier’s checks are essential tools in the personal finance toolkit. While money orders are budget-friendly and accessible, cashier’s checks offer superior security for large transactions. Knowing the differences allows you to manage your finances with confidence and reduce the risks of fraud or payment failure.

By understanding the mechanics and best practices of each method, you position yourself as a smarter, safer financial decision-maker.

Related Frequently Asked Questions (FAQs)

Here are questions people oftens ask about money orders vs. cashier's checks.

Can I Get a Cashier’s Check Without a Bank Account?

No, you generally cannot get a cashier’s check without having a bank account. Cashier’s checks are issued directly by banks or credit unions and are funded by withdrawing the amount from your personal or business account. As a result, they are typically only available to account holders.

If you need a secure form of payment and don’t have a bank account, a money order may be a better option. Money orders can be purchased with cash or debit at post offices, convenience stores, and other retail outlets.

Who Signs the Back of a Cashier’s Check?

Only the recipient (payee) should sign the back of a cashier’s check—and only when they are ready to deposit or cash it. The person or business receiving the funds must endorse the check in the designated area on the back, just like they would with a personal check.

It’s important not to sign the back too early, especially if you are mailing or handing it over to someone else, to prevent misuse in case the check is lost or stolen.

What Happens If a Cashier’s Check Is Not Cashed?

If a cashier's check is lost or not cashed immediately, it may still be cashed later. Cashier’s checks do not technically expire, but they may become more difficult to cash if left outstanding for an extended period—typically six months or more. After a certain time, banks may require additional verification or may treat the funds as unclaimed property.

In many states, uncashed cashier’s checks may eventually be turned over to the state’s unclaimed property division under escheatment laws. If you're the purchaser and the check hasn't been deposited, you can request a refund or reissue, though banks often charge a fee and require a formal indemnity process.

Which Is Better: A Money Order or a Cashier’s Check?

It depends on the amount of the transaction, the level of security required, and whether or not you have a bank account.

- Money orders are better for small, everyday transactions (typically under $1,000) and are accessible without a bank account. They’re inexpensive and widely available at post offices, retail stores, and convenience outlets.

- Cashier’s checks are better for large or high-stakes payments where guaranteed funds and added security are essential—such as buying a car, paying a security deposit, or closing on a home.

If you're making a large payment and want to ensure the recipient gets secure funds quickly, a cashier’s check is the preferred option. For lower-cost or informal payments, a money order is usually sufficient and more affordable.

Do Banks Charge for Cashier’s Checks?

Yes, most banks and credit unions charge a fee for issuing cashier’s checks. Fees generally range from $10 to $20, though some institutions waive the fee for customers with premium or relationship accounts.

Examples:

- Chase: $10 (waived for select accounts)

- Bank of America: $15

- Wells Fargo: $10

- Credit unions: Often charge less, but policies vary

If you’re considering a cashier’s check, check with your bank beforehand to see if you’re eligible for a fee waiver or if alternatives like money orders might be more cost-effective for your situation.

What Can a Money Order Be Used For?

Money orders can be used for a wide range of purposes where a secure, prepaid payment method is needed. Common uses include:

- Paying rent or utility bills

- Making online or classified purchases (e.g., Craigslist, Facebook Marketplace)

- Sending domestic or international remittances

- Paying court fees, fines, or government services

- Completing private sales without sharing bank information

Because they don’t require a bank account and are considered safer than mailing cash, money orders are particularly useful for the unbanked, underbanked, or anyone seeking privacy in financial transactions.

Why Would a Person Use a Money Order Instead of a Check?

A person might choose a money order over a personal check for several reasons:

- Anonymity and security. Money orders don’t include sensitive bank details, reducing the risk of fraud or identity theft.

- Guaranteed funds. Unlike personal checks, money orders are prepaid, so they can’t bounce.

- No bank account required. Money orders can be purchased with cash or debit, making them ideal for those without checking accounts.

- Greater acceptance. Some businesses or landlords refuse personal checks but will accept money orders due to their guaranteed nature.

This makes money orders a valuable tool in situations where security, reliability, and accessibility are top priorities.