How to Read Your Pay Stub for Loan Applications

Understanding your pay stub is one of the most practical steps you can take when preparing for a loan application. This guide is built on current lending practices and designed to help you navigate the income verification process with clarity and confidence. Whether you're applying for a personal loan, auto loan, or mortgage, knowing what lenders look for can help you avoid common delays and better understand their decision-making process. This isn't about encouraging borrowing; it's about helping you make informed decisions.

Pay stubs serve as critical documents in loan applications because they verify your employment, confirm consistent income, and help lenders assess your ability to repay. However, interpretation can vary based on the type of loan, your employer's payroll system, and how frequently you're paid. Understanding these nuances puts you in a stronger position from the start.

Key Takeaways

- Understanding how to read your pay stub and what lenders look for can significantly reduce delays and stress during the loan application process.

- Knowing the difference between gross and net income, understanding how pay frequency affects annual calculations, and being aware of what YTD totals reveal about your earnings history all contribute to a smoother experience.

- This knowledge doesn't guarantee approval, but it does help you present your financial situation clearly and accurately.

- It also empowers you to assess whether a loan truly fits your budget based on your actual take-home pay, not just what a lender is willing to approve.

Why Lenders Ask for Pay Stubs

Lenders request pay stubs to verify three fundamental aspects of your financial situation: employment stability, consistent income, and your capacity to manage loan payments responsibly. These documents provide a snapshot of your current employment and earnings that goes beyond what you might report on an application form.

The way lenders review pay stubs can differ depending on the loan type. Personal loans and installment loans often focus on steady income and a favorable debt-to-income ratio. Mortgage lenders typically conduct more thorough income verification, sometimes requiring several months of documentation to verify income. Auto lenders may have more flexible requirements, but still need proof that your income supports the monthly payment.

It's important to understand that pay stubs alone don't determine loan approval. Lenders consider your credit history, existing debts, employment history, and other financial factors. Pay stubs are one piece of a larger evaluation, not a guarantee of approval or denial.

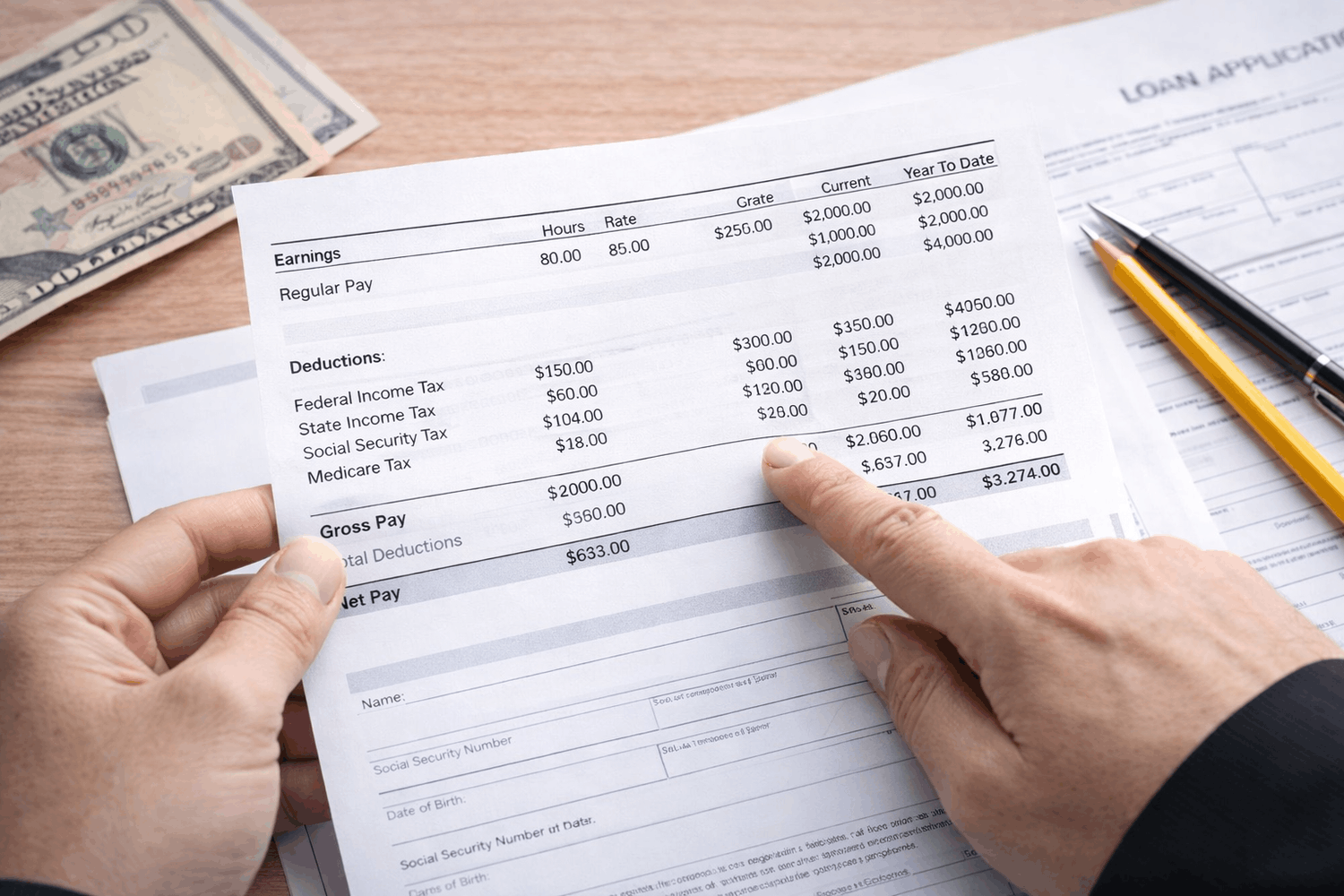

What a Pay Stub Shows (At a Glance)

Your pay stub contains several distinct sections, each serving a specific purpose in the income verification process. Familiarizing yourself with these components helps you understand what lenders are reviewing and ensures you can answer questions if they arise.

|

Pay Stub Section |

What It Shows |

Why Lenders Care |

|

Employee & Employer Info |

Your name, employer name, and address |

Verifies employment relationship and identity |

|

Pay Period & Pay Date |

When you worked and when you were paid |

Determines how to calculate annual income |

|

Earnings (Gross Income) |

Total pay before deductions |

Primary measure of earning capacity |

|

Taxes & Deductions |

What's withheld from your paycheck |

Shows obligations, but usually doesn't affect approval |

|

Net Income |

Actual take-home pay |

Helps assess real affordability |

|

Year-to-Date (YTD) Totals |

Cumulative earnings and deductions |

Verifies income consistency over time |

Each section tells part of your income story, and lenders often cross-reference these details to verify consistency and authenticity.

Employee and Employer Information

The top portion of your pay stub typically displays your legal name, address, employee identification number, and your employer's name and address. Lenders compare this information against your loan application and other documents to ensure everything matches.

Pay frequency is also noted here, whether you're paid weekly, bi-weekly (every two weeks), semi-monthly (twice per month), or monthly. This detail matters because lenders use it to calculate your annual income accurately. Someone paid bi-weekly receives 26 paychecks per year, while a semi-monthly employee receives 24.

Common red flags that can raise questions:

- Name mismatches between your pay stub and loan application

- Missing or incomplete employer information

- Recently changed jobs without explanation

- Pay stubs from unlicensed or unverifiable employers

If you've switched jobs within the past few months, be prepared to explain the transition and provide documentation from your previous employer if requested. Recent job changes don't automatically disqualify you, but they may require additional verification.

Pay Period & Pay Frequency (Why It Matters for Loans)

Lenders normalize your income to an annual or monthly figure to compare it against the loan amount and your other obligations. This process requires understanding your exact pay schedule.

How pay frequency affects annual income calculation:

|

Pay Frequency |

Paychecks Per Year |

Example: $2,000/Check |

Annual Income |

|

Weekly |

52 |

$2,000 |

$104,000 |

|

Bi-weekly |

26 |

$2,000 |

$52,000 |

|

Semi-monthly |

24 |

$2,000 |

$48,000 |

|

Monthly |

12 |

$2,000 |

$24,000 |

If you work inconsistent schedules, such as gig work, shift-based roles, or jobs with significant overtime variation, lenders typically review several months of pay stubs to identify patterns. They may average your income over time rather than relying on a single pay period. This approach protects both you and the lender by creating a more realistic picture of what you can afford.

Variable income isn't necessarily a problem, but it does require more documentation and may result in lenders using a conservative estimate of your earnings when determining loan eligibility.

Gross Income Explained (What Lenders Focus On)

Gross income represents your total earnings before any taxes or deductions are taken out. For most loan applications, this is the primary figure lenders examine.

What's typically included in gross income:

- Base salary or hourly wages

- Consistent overtime pay

- Regular bonuses and commissions

- Tips (if documented on pay stub)

- Shift differentials or hazard pay

What lenders may exclude or average:

- One-time bonuses or signing bonuses

- Sporadic overtime that varies significantly

- Expense reimbursements

- Non-recurring payments

Lenders focus on gross income because it provides the clearest measure of your earning capacity. However, they distinguish between regular and irregular income. Base salary and consistent overtime are typically counted in full, while sporadic bonuses or one-time payments may be excluded or averaged over a longer period.

If your pay stub includes unusual items or categories, be prepared to explain them. Transparency helps prevent misunderstandings that could delay your application. Gross income serves as the foundation for most loan calculations, but it's not the only factor lenders consider when assessing affordability.

Taxes and Pre-Tax Deductions

Your pay stub shows various deductions that reduce your gross income before you receive your paycheck.

Mandatory tax withholdings:

- Federal income tax

- State and local income taxes

- Social Security (FICA)

- Medicare

Common pre-tax deductions:

- Health insurance premiums

- Dental and vision insurance

- 401(k) or other retirement contributions

- Flexible Spending Accounts (FSA)

- Health Savings Accounts (HSA)

- Commuter benefits

These deductions directly impact your take-home pay, but they don't always affect how lenders calculate your qualifying income. Most lenders still use your gross income for approval decisions, though they may consider your net income when assessing whether the monthly payment fits your budget.

It's worth noting that lenders don't judge how you allocate your deductions. Contributing to retirement or paying for health insurance demonstrates financial responsibility, and these choices don't negatively impact your application.

Net Income (Take-Home Pay) and Why It Still Matters

Net income is what remains after all taxes and deductions are subtracted from your gross pay. This is the actual amount deposited into your bank account or handed to you in a paycheck. While lenders often use gross income for qualification purposes, net income plays a crucial role in determining true affordability.

Some lenders, particularly those offering smaller personal loans or short-term financing, may focus more heavily on net income. They want to ensure that after all your obligations are met, you have sufficient funds to cover the new loan payment comfortably. Budget-based underwriting approaches look at your actual cash flow rather than just gross earning power.

Understanding your net income helps you assess whether a loan payment is realistic for your situation. Even if a lender approves you based on gross income, you're the one who needs to manage the payment within your actual take-home budget. Being honest with yourself about affordability helps you avoid taking on debt that could strain your finances.

Year-to-Date (YTD) Earnings Explained

Year-to-date totals show your cumulative earnings and deductions from January 1st through the end of the current pay period. Lenders use YTD figures to verify income consistency, spot any significant changes in your pay, and confirm that your recent pay stubs align with your overall earnings pattern for the year.

If you received a raise, experienced reduced hours, or had a gap in employment, YTD totals help lenders understand the context. They may calculate an average based on YTD figures and the number of pay periods that have occurred, then compare it to your current earnings to see if your income is stable, increasing, or decreasing.

Common mistakes include applying for a loan very early in the year when YTD totals are limited, making it harder for lenders to assess consistency, or failing to explain partial-year employment if you started your job mid-year. If unusual circumstances affect your YTD totals, providing a brief explanation can prevent confusion and potential delays.

Common Pay Stub Mistakes That Can Delay Loan Approval

Simple errors in how you submit pay stubs can create unnecessary delays in the approval process. Being aware of these common issues helps you submit clean, complete documentation from the start.

Documentation errors to avoid:

- Missing pages or cropped screenshots. Submit complete, unaltered documents showing all sections clearly

- Outdated pay stubs. Use pay stubs from the most recent 30-45 days, not documents from several months ago

- Illegible uploads. Ensure scans or photos are sharp and readable with good lighting and no shadows

- Inconsistent income between stubs. If earnings vary significantly, be ready to explain why (overtime changes, bonuses, etc.)

- Recently changed employers. Provide context about job transitions and previous employment if requested

- Altered or edited documents. Never modify pay stubs, even to highlight information or correct minor errors

These issues reflect common challenges in real loan applications. A blurry photo or incomplete PDF forces lenders to request replacements, adding days or weeks to your approval timeline.

How Many Pay Stubs Do Lenders Usually Require?

Most lenders request one to three recent pay stubs, typically covering the most recent 30 to 45 days. The exact requirement depends on the lender's policies, the loan type, and your specific employment situation.

If you have variable income from overtime, commissions, or bonuses, lenders may ask for additional months of pay stubs to establish an accurate average. Jobs with significant overtime may require proof that the extra hours are consistent rather than a one-time occurrence. If you recently transitioned from self-employment to traditional employment, lenders might want to see a longer history to confirm stability.

Requirements vary by lender and loan program, so it's always worth asking upfront what documentation you'll need. Having extra pay stubs on hand can speed up the process if the lender requests more information.

What to Do If You Don't Have Traditional Pay Stubs

Not everyone receives standard pay stubs. If you work for a small employer, are paid through cash or direct deposit without detailed documentation, or have recently started a new job, you may need to provide alternative proof of income.

Acceptable alternatives lenders may accept

- Bank statements – Showing regular deposits from your employer (usually 2-3 months)

- Employer verification letter – Official letter on company letterhead confirming employment, position, and income

- Payroll app screenshots – From platforms like ADP, Paychex, or Gusto (some lenders may require official exports)

- Tax returns – W-2s or 1099s from the previous year (less current but shows annual income)

- Signed offer letter – For very new employees who haven't received their first paycheck

Limitations to understand

- Bank statements show deposits, but may not break down gross versus net income or deductions

- Employer letters confirm income but lack the detailed payment history that pay stubs provide

- Screenshots are easier to manipulate, so some lenders won't accept them without additional verification

- Alternative documentation may limit your loan options or result in higher interest rates

If you don't have traditional pay stubs, communicate with your lender early in the process to understand what they'll accept and set realistic expectations about the approval timeline.

Can You Get a Loan With Inconsistent or Changing Income?

Inconsistent income doesn't automatically disqualify you from getting a loan, but it does make the approval process more complex. Lenders evaluate job changes by looking at whether you stayed in the same field, maintained or increased your income, and how recently the change occurred. Moving to a higher-paying position in your industry is typically viewed more favorably than switching careers entirely.

Reduced hours or seasonal employment patterns require careful documentation. Lenders may average your income over a full year to account for fluctuations, or they may use your lower earning periods to be conservative in their assessment. If your income varies significantly throughout the year, be prepared to explain the pattern and provide additional documentation.

Honesty is critical when dealing with income changes. Misrepresenting your situation or trying to hide recent reductions can lead to denied applications or, worse, approval for a loan you can't actually afford. If your income has decreased or become less stable, it may be worth waiting until your situation stabilizes before taking on new debt.

It's also important to consider whether borrowing is appropriate during a period of income instability. Even if a lender approves your application, you need to assess whether the payment fits your current and anticipated financial reality.

Auto Loans and Pay Stub Requirements

Auto loans typically have more streamlined documentation requirements compared to mortgages, but pay stubs still play an important role in the approval process. Understanding what auto lenders specifically look for can help you prepare and potentially secure better loan terms.

How Auto Lenders Evaluate Pay Stubs

Auto lenders focus primarily on verifying that your income can support the monthly car payment alongside your existing obligations. They calculate your debt-to-income ratio by comparing your monthly debts (including the proposed car payment) to your gross monthly income. Most auto lenders prefer to see a debt-to-income ratio below 40-50%, though this varies by lender.

The verification process for auto loans is generally faster than for mortgages. Many dealerships work with multiple lenders who may have different requirements, so having your pay stubs ready can help you compare offers quickly. Some auto lenders place more emphasis on your down payment and the value of the vehicle as collateral, which may make income verification slightly less stringent than with unsecured loans.

Special Considerations for Car Loans

If you're trading in a vehicle, lenders will factor the trade-in value into their calculations, which can affect how much weight they place on your income verification. A larger down payment or substantial trade-in equity may result in approval even with borderline income documentation.

Auto lenders are often more accommodating of recent job changes if you've stayed within the same industry and maintained similar income levels. The shorter loan terms (typically 3-7 years versus 15-30 years for mortgages) mean lenders may be more flexible about recent employment transitions.

Getting an Online Loan With Pay Stubs

If you have recent, consistent pay stubs, you're in a strong position to qualify for competitive loan rates. Traditional lenders, including banks, credit unions, and online lenders typically offer their best terms to borrowers who can provide clear income verification through standard pay stubs.

When you have solid documentation, you can shop around more effectively. Compare interest rates, loan terms, and fees from multiple lenders. Your pay stubs demonstrate stability and earning power, which gives you leverage to negotiate better terms or seek out lenders who specialize in borrowers with strong employment histories.

Consider the timing of your application. If you're expecting a raise, bonus, or promotion, waiting until it's reflected on your pay stub could improve your loan terms. Similarly, if you've recently started earning overtime consistently, having a few months of pay stubs that show this pattern can strengthen your application.

No Pay Stub Loans: What You Need to Know

Some lenders offer loans specifically designed for borrowers without traditional pay stubs. These options serve self-employed individuals, gig workers, freelancers, and those with non-traditional employment arrangements. While these loans provide valuable access to credit, they typically come with different requirements and terms.

Common features of no pay stub loans:

- Higher interest rates to offset the lender's increased risk

- Alternative income verification through bank statements, tax returns, or 1099 forms

- Potentially lower loan amounts or shorter terms

- May require larger down payments or additional collateral

- Often involve more thorough review of your overall financial picture

Who might benefit from no pay stub loans:

- Self-employed professionals with irregular income

- Independent contractors and freelancers

- Small business owners who pay themselves differently

- Workers in cash-based industries

- Those transitioning between employment types

When considering a no pay stub loan, carefully review all terms and ensure you understand the total cost of borrowing. These loans can provide essential financing when you need it, but the higher costs mean you should borrow only what you truly need and can comfortably repay.

Some lenders specialize in working with non-traditional employment situations and may offer more favorable terms than others. Research lenders who specifically advertise flexibility with income documentation, and don't hesitate to explain your unique situation upfront.

Final Tips Before Submitting Your Pay Stub

Before you upload or hand over your pay stubs, take a few minutes to review them carefully. Check that all information is accurate, including your name, employer details, and income figures. Verify that the pay dates fall within the timeframe your lender specified, typically the most recent 30 to 45 days.

Make sure you're submitting full, clear documents. If you're photographing a paper stub, ensure good lighting and a steady hand so all text is legible. If you're downloading from an online payroll portal, save the complete PDF rather than taking screenshots of individual sections.

Take time to understand what your pay stub reveals about your income. Knowing your gross pay, net pay, and YTD totals helps you answer questions confidently if your lender asks for clarification. Remember that lenders are looking at the numbers and consistency, not judging your financial choices or employment situation.

Related Frequently Asked Questions (FAQs)

Here are questions people often ask about pay stubs:

How many pay stubs do I need for a car loan?

Most auto lenders require one to two recent pay stubs, typically from the last 30 days. The relatively streamlined requirements for auto loans reflect the fact that the vehicle serves as collateral, reducing the lender's risk compared to unsecured loans.

However, your specific situation may require additional documentation. If you have variable income from commissions, bonuses, or irregular overtime, lenders might request two to three months of pay stubs to calculate an average. Recent job changes may also prompt requests for additional verification or documentation from your previous employer.

Dealership financing departments often work with multiple lenders simultaneously, and different lenders may have varying requirements. Having at least two months of pay stubs available when you visit a dealership ensures you're prepared regardless of which lender ultimately approves your loan. This preparation can also speed up the approval process and get you into your vehicle faster.

How many pay stubs do I need for a home loan (mortgage)?

Mortgage lenders typically require at least two recent pay stubs, usually covering the most recent 30 days, though many ask for 60 days of documentation. The more thorough requirements for home loans reflect the significant financial commitment and longer loan terms involved in mortgage lending.

Beyond pay stubs, mortgage lenders conduct comprehensive income verification that often includes W-2 forms from the past two years, recent tax returns, and verification of employment directly with your employer. If you're self-employed or have income from multiple sources, expect to provide additional documentation such as profit and loss statements, business tax returns, or 1099 forms.

Mortgage underwriting is significantly more detailed than other loan types. Lenders may request explanations for any gaps in employment, significant changes in income, or unusual deposits shown on your bank statements. If you've recently changed jobs, even with increased income, be prepared to provide a written explanation and possibly additional verification.

The specific requirements also vary by loan program. FHA, VA, conventional, and jumbo loans each have their own guidelines for income documentation. Working with a mortgage professional early in the process helps you understand exactly what you'll need and identify any potential issues before you find your dream home.

What about fake pay stubs? Can I use them to get a loan?

Using fake or altered pay stubs to obtain a loan is fraud, plain and simple. It's illegal, carries serious consequences, and is never worth the risk. Beyond the legal implications, using fraudulent documentation to secure a loan you can't actually afford sets you up for financial hardship and potential default.

Why you should never use fake pay stubs:

- It's a federal crime. Loan fraud can result in criminal charges, fines up to $1 million, and prison sentences up to 30 years under federal law

- Lenders verify everything. Modern lenders use sophisticated verification systems, contact employers directly, cross-reference tax records, and review bank statements. Fake documents are usually caught during underwriting

- You'll face serious consequences. Even if initially approved, discovery of fraud can trigger loan acceleration (demanding full immediate repayment), criminal prosecution, civil lawsuits, and permanent damage to your credit

- It ruins future opportunities. Loan fraud stays on your record and can prevent you from getting legitimate financing for years or decades

- You're setting yourself up for failure. If you can only qualify with fake documents, you likely can't afford the loan, which leads to default, repossession, or foreclosure

What to do instead:

If you're struggling to qualify for a loan with your current income, consider legitimate alternatives. Work on improving your credit score, saving for a larger down payment, reducing existing debts, or waiting until your income increases naturally. If you need financing urgently, look into lenders who specialize in non-traditional income verification or alternative loan products designed for your situation.

Some people turn to pay stub generator websites, thinking they're harmless tools, but using these to misrepresent your income is fraud, regardless of how easy the technology makes it. Lenders know these tools exist and specifically look for signs of fabricated documents.

If you've already used or considered using fake pay stubs, stop immediately. If you've submitted fraudulent documents, consult with a legal professional about your options. The consequences of continuing down this path far outweigh any short-term benefit of loan approval.

Honest financial difficulty is not a crime, but lying about your income to obtain a loan is. There are always better options than fraud, even if they require more patience or compromise.