29 Passive Income Ideas To Help You Make Money in 2026

Striving for financial stability can often feel like a constantly shifting target in today's world, making it a challenge to attain. To inch closer to financial security, harnessing the power of "passive income" can be a game-changer. The real question is: which passive income strategy aligns best with your goals and circumstances?

Key Takeaways

- Passive income offers an opportunity to earn money with minimal active involvement.

- Passive income involves making an initial investment of time and money, which, once established, continues to generate earnings without constant, hands-on effort. This sets it apart from active income, which typically requires a significant time commitment.

What Is Passive Income?

Passive income is a means of generating income with minimal active involvement. Usually, creating a passive income stream requires an initial investment of time and money, but once this groundwork is in place, it typically continues to yield earnings without the need for ongoing, hands-on effort.

This distinct characteristic sets passive income apart from active income, which often demands a significant time commitment to generate earnings. In the following sections, we'll explore the nature of passive income by clarifying what it is not.

Passive Income Is Not

Passive income is not like a job because it does not come from being materially involved. It is not the same thing as a second job, nor is it a get-rich-quick scheme.

You will have to do some work at the beginning of setting up passive income, but after that, you will not be required to stay in a fixed place for a fixed amount of time, or even do fixed tasks, to earn money.

As you’ll see in the examples we provide below, passive income is a way to gain money with very minimal personal involvement.

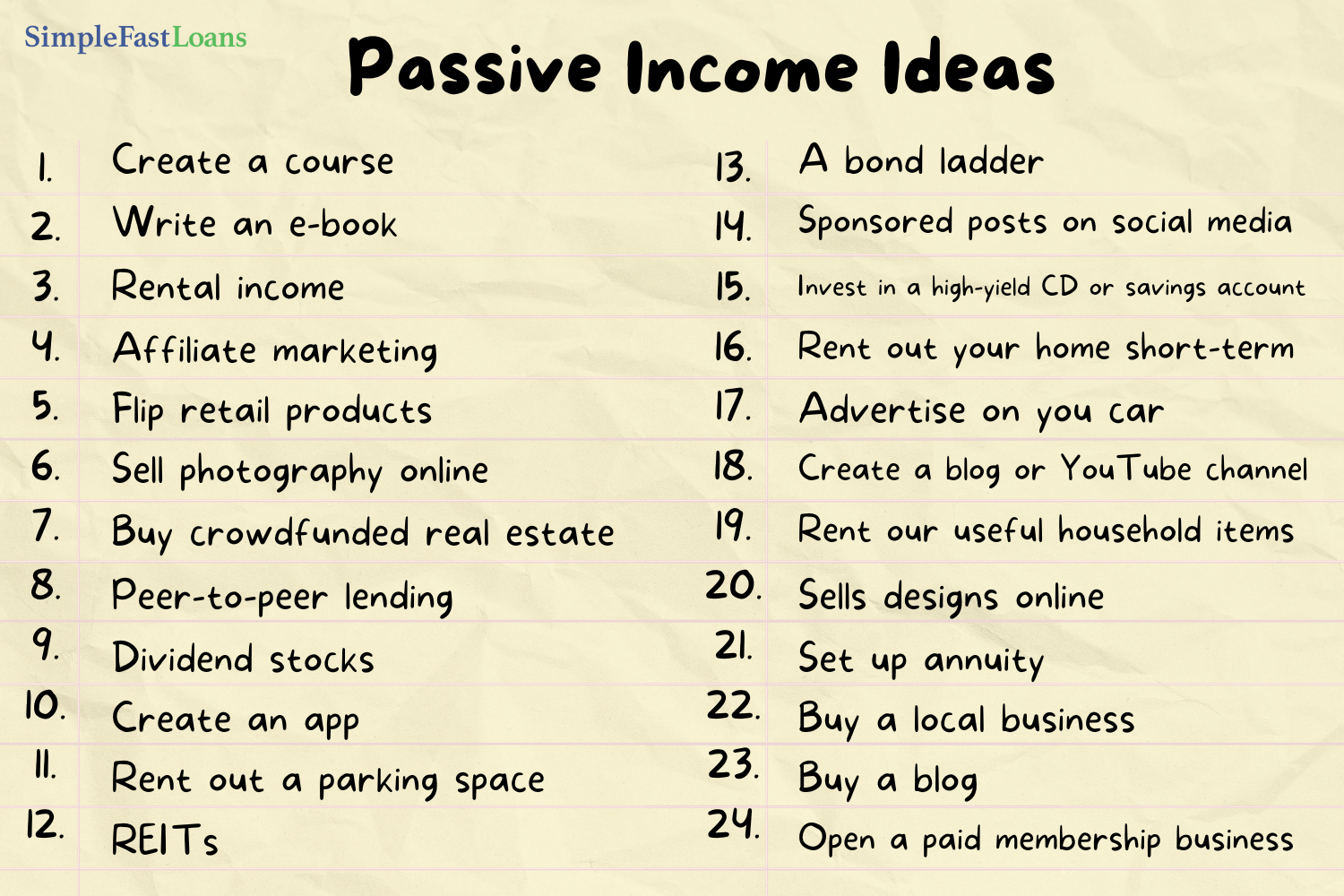

27 Passive Income Ideas For Making Money

Below, you’ll find enough passive income ideas to get you started on your way to earning more.

1. Create a Course

Creating an online course is one of the most lucrative forms of passive income. This is because, according to estimates by Devlin Peck, online learning is expected to have a 9.1% annual growth rate in the next three years.

Creating an online course is also relatively easy to do. To create one, you must have a subject that you’re knowledgeable about or have some certification of expertise in. Then, demonstrate that knowledge by pre-selling the course.

This can look like releasing the first few webisodes or tutorials for free online, with a link included to purchase the rest of your course. This allows a target market to grow and it allows you to measure their interest. Once the course is set up and your sales are automated, you’ll have no more active involvement, making this an ideal way to generate passive income.

2. Write an e-Book

Writing an e-Book is an excellent way to earn passive income because it is not only a way to capitalize on your experience, but doubles as a platform for your views.

The key to gaining passive income from writing an e-Book is to select the perfect topic. The subject of your e-Book should be:

- Marketable

- Unique

- Fitting with your expertise

You don’t want to write a book so unique that only a very few people are interested in reading it. However, you also want to avoid writing an e-Book that will have to face heavy competition from the others that are written on the same subject.

Above all, an e-Book that is made to generate passive income should not demand too much research from you; it should be something that you already understand and feel passionately about.

When all of these factors are in place, select an online publishing website that, again, balances how much time and money you’re willing to invest with how much of a profit you stand to gain once the book is distributed. Many publishing sites will provide you with important parameters, such as formatting, which can help you get started in writing the e-Book.

3. Rental Income

Renting out one of your properties to a tenant can provide passive income in more ways than one. For example, when a rental property is established and a tenant is secured, the most obvious income stems from rent payments.

However, capital gains are also possible on rental properties. Capital gains come when you decide to sell the property, typically for more than what was paid for it. Though this is technically a type of passive income, it is not as lucrative as the tax write-offs you may benefit from as a third type of passive income from rentals.

The most useful tax write-off is depreciation, which is a type of non-cash expense that can be claimed on a tax return for reflecting the natural deterioration of the value of the property. In short, renting a property is one of the most useful ways to make passive income.

4. Affiliate Marketing

This online type of marketing brings in highly beneficial amounts of passive income. You will earn commission simply by promoting a third party’s services or products. This cuts down on the expense you might get into by trying to create products of your own or handling any of the minutiae of running a business, such as shipping.

It also comes with some significant freedom, since you can choose products or services that you’re actually passionate about. Simply find a product you’d like to promote, such as finances or beauty products.

Next, join an affiliate program connected to that product and submit your application. You’ll need to have an active and popular social media account to make the most of this. Afterward, promote the product through regular updates to social media accounts, email marketing, or even blog posts.

Though this does require a slight time investment at the beginning of the affiliation, you’ll earn commission money any time someone clicks on the link and purchases the product that you’ve been promoting.

5. Flip Retail Products

On sales platforms located exclusively online, you can sell any product you have after finding them at low prices, yourself. This means a low investment of money on your end and a high possibility for continued earnings.

After all, what you may find at a thrift store or garage sale could be something that several people would consider a treasure. The best way to take advantage of this type of passive income is to find an entire category of products that are this way, such as vintage apparel or discontinued accessories.

Then, after finding a regular source for discounted items in this category, you can build an online following of buyers interested in that category and sell to them at a discounted rate. The goal is to gain a following to create semi-regular income.

6. Sell Photography Online

Selling your own photographic work can be a heavy investment in time as you build up a regular audience of potential customers, but it is definitely worthwhile. Find a platform online that sells photos and obtain a license. This will lead to payment from the online platform whenever your photos are downloaded.

That being said, you’ll need to find models or landscapes that interest a regular audience in order to turn this into a beneficial source of passive income.

7. Buy Crowdfunded Real Estate

Real estate can often be looked at as a very active income avenue. However, by buying crowdfunded real estate, you can make money without having to do as much of the repair work, tenant communication, or overall management of the property.

An investing team will generally pick out attractive real estate properties and then put those properties on their website or provide the opportunity to invest in them to buyers like you. Just be sure you know which kind of platform you’ll be investing in; some invest in debt and some invest in equity, while others require accredited investors.

Remember, buying crowdfunded real estate is a bit of a gamble; there is no guarantee that even the most attractive real estate properties will generate high returns.

8. Peer-to-Peer Lending

This personal loan is made between a borrower and a lender, usually between peers instead of full-on organizations. The personal loan is usually regulated through at least one outside intermediary, but the attraction of this passive income idea is the freedom the lender can experience.

You’ll be able to choose who you’d like to lend to with little restrictions. However, remember that a peer-to-peer loan is unsecured, and you’ll have to invest a lot of time to understand its strategy and the best way to receive regular payments at the beginning.

9. Dividend Stocks

Stocks that yield dividends provide regular payments to shareholders in connected companies. Usually, this payout comes every quarter and stems from the profits of the company. All that’s required of the shareholder is an investment in the stock.

You’ll be able to make an income from these investments with little to no involvement after owning the stock, but all of the benefits hinge on whether or not the most lucrative, diverse stock is chosen.

10. Create an App

Another creative way to generate passive income is by creating your own mobile app. You’ll have to invest a lot of time into programming, designing, and marketing the app. However, once this process is finished and a target audience is reached, the app generates income with no need for much further involvement.

One way to make sure an app remains lucrative as a source of passive income is to add new, small features that keep it interesting for users. Another is to run ads within the app or charge a fee for the initial download.

11. Rent Out a Parking Space

Sometimes, in your source of active income like a place of employment, you have access to your very own parking spot. This can become a source of passive income when you allow others to park there for a price.

If you live near a venue where concerts are popularly held, or even if you have a parking spot near a popular but limited place of business, this can be a great way to make money. The key is to be well aware of your residency or business property’s laws, and make sure your parking spot is protected from liability suits with the proper disclaimers.

12. REITs

The acronym “REIT” stands for “real estate investment trust,” or a company that manages property. Their structure in the legal field makes it so that REITs do not need to pay much, or any, corporate income tax as long as their shareholders get the brunt of their income.

Purchase stock in a REIT to earn whatever they choose to pay out, but remember, you’ll need to do adequate research on the companies you buy stock in.

13. A Bond Ladder

This can describe many different bonds that grow over time. Because their maturity is staggered, the risk of the investor is lowered, and so are interest payments.

This passive investment idea has been popular for a long time, especially among those who are retired or, for whatever reason, no longer have a source of active income.

What’s especially nice about bond ladders is that one can create the income needed to invest in another, and therefore, the passive income can snowball into a sizeable chunk of money!

14. Sponsored Posts on Social Media

This passive income idea is another that requires a strong social media presence. Brands in retail, food service, or even travel will happily pay a popular influencer to sponsor their products.

This can be a type of passive income, but you’ll need to strategize how often you post and how popular these posts are in order to prevent influencing from becoming a full-time job: you may find yourself gaining an active income to keep your followers interested and your sponsors happy!

15. Invest in a High-Yield CD or Savings Account

A certificate of deposit account or a savings account that produces high yields can easily generate passive income. High interest rates can be one of the most successful ways to make money without having to lift a finger.

Online accounts are usually the best place to start when finding the best CD account, but remember, inflation can cause the returns on this investment to fluctuate in value.

16. Rent Out Your Home Short-Term

If you don’t have the above-mentioned extra property to rent out, you might consider renting out your own home as a type of passive income. List the home on several high-quality websites in order to get the most publicity, and make sure you have a place to stay, yourself, in the meantime!

17. Advertise on Your Car

Advertising on your own car is one of the cleverest passive income ideas. All you need to do is contact an advertising agency that allows a car to become a moving billboard.

You’ll need to be a trustworthy driver for agencies to allow this, and then all you need to do is drive your vehicle along any of your day-to-day routes while it sports the advertisement of your sponsor! For this, you’ll be paid handsomely.

18. Create a Blog or YouTube Channel

Similarly to social media sponsors, creating a YouTube channel or a blog can be a great way to earn income. As your followers grow thanks to relevant and engaging content, you’ll be able to be paid by the platform itself for attracting online traffic to the site.

Pick a very specific topic and make yourself the foremost, and most engaging, authority on it. It helps if the subject is something you love. Then, make as many blog posts or YouTube videos as you can to build a following regularly!

19. Rent Out Useful Household Items

Useful household items to rent out can be expensive tools, vacuum cleaners, camping gear, or even containers. Neighbors or social media friends may have events or house renovations coming up, and when they see that you have items that could be useful, you’ll be in business for passive income!

20. Sell Designs Online

If you’ve got artistic know-how, consider creating eye-catching designs and finding a platform that allows you to make merchandise with these. Apparel, keychains, and even stickers are all the rage; it won’t me difficult to market your product as long as you have a great and memorable design and select the best platform to sell it on.

21. Set Up an Annuity

Annuities are a financial strategy in which money is given to a company that will steadily return that money as a source of income in the future. They can be set up in several different ways, but in general they pay out every month.

The only downside is that they are complicated to set up and can be a pain to pay to; this is the first investment that will, if successful, turn into passive income later on.

22. Buy a Local Business

Local businesses that are already popular and lucrative can be a great investment. You won’t need to worry about the grind of starting and marketing a new business; if it is already established and well-liked, simply purchase the business and keep a knowledgeable manager in charge of the day-to-day.

23. Buy a Blog

If you don’t have time to build up a following on your own blog, simply buy an established one. Just like a local business that is already up and running, a blog, and any connected sponsors or paying platforms, can provide you with low-maintenance passive income.

24. Open a Paid Membership Business

Membership businesses allow members to have access to products, opportunities, or resources in exchange for a fee paid on a subscription. Though this is something like creating your own business, once it is set up, you’ll be easily making a passive income thanks to those regular user fees.

25. Make Print-On-Demand Designs

The difference between regular designs and print-on-demand designs is that print-on-demand designs do not need to be mass-produced. All you need to do is create a design and advertise it on a platform that manufactures and sells the items only after they are purchased.

There is a chance demand will increase later on, but as this is only a sign of popularity and therefore greater income, you may not mind when passive becomes active!

26. Offer Software as a Service (SaaS) Business

SaaS is a highly sought-after skill in today’s bustling age of technology. Make it work for you by creating a quick portfolio of your skillset and an online business profile. Then, when others need software services, you’ll be all set up to provide it with little prior investment of time.

27. Create No-Code Apps

No-code apps are very simple, one-function applications that require almost no maintenance and very little from their creators. Some of these include very simple website-building apps or database tools for collaboration.

28. License Your AI-Generated Assets

AI content creation exploded in the last few years, and now creators can license AI-generated images, datasets, short-form videos, templates, and even AI agents for commercial use.

You can earn passive income by creating and selling:

- AI-generated stock photos

- Prompt packs

- Pre-trained niche AI models

- AI-generated digital backdrops

- Chatbot templates for small businesses

Once listed on marketplaces, these assets sell repeatedly with no extra effort.

29. Earn Royalties from Digital Templates

People now rely on templates for:

- AI workflows

- Marketing funnels

- Legal forms

- Content calendars

- Spreadsheet dashboards

Template marketplaces are booming, and a single upload can earn for years.

Which Passive Income Source Is Best For You?

The best way to select a passive income source for your own personal life is to examine what it is that comes naturally to you. If you understand the balance of risk and reward in investing, then perhaps buying a locally established business or investing in a bond ladder is right for you.

On the other hand, if you wish you had more of a creative outlet in your life, turning that passion into money is easy with print-on-demand designs or even the creation of an e-Book.

Once you have a passion singled out, you’ll automatically find that the investment of time or money won’t feel steep or difficult, and the reward is more than worthwhile!