Saving for Both a Down Payment and an Emergency Fund

Building financial security is one of the most important things you can do for your long-term wellbeing. Two key components of that security are a down payment for a home and an emergency fund to cover unexpected expenses. That said, here are five steps to accomplish both savng for a downpayment and an emergency fund simultaneously.

While these savings goals may seem daunting at first, with a thoughtful strategy and consistent effort, they are very achievable for most people.

What Is a Down Payment?

A down payment is a lump sum of money that a home buyer pays upfront when purchasing a property. This initial payment, typically 5-20% of the home's total price, reduces the amount the buyer needs to borrow through a mortgage loan.

Why Save for a Down Payment?

There are several key reasons why saving for a down payment is so important:

- Lower monthly payments. A larger down payment results in a smaller mortgage, which translates to lower monthly payments. This can make homeownership more affordable in the long run.

- Avoid Private Mortgage Insurance (PMI). With a down payment of less than 20%, most lenders will require the buyer to pay for private mortgage insurance. Saving enough for a 20% down payment can help buyers avoid this additional monthly cost.

- Build home equity faster. The more you put down upfront, the more equity you build in the home from the start. This equity can be accessed later through refinancing or home sales.

- Qualify for better loan terms. Larger down payments make buyers appear less risky to lenders, which can result in lower interest rates and more favorable loan terms.

- Demonstrate financial responsibility. Saving for a down payment shows mortgage lenders that a buyer is financially responsible and capable of managing their money.

The recommended down payment amount can vary, but most financial experts advise aiming for at least 10-20% of the home's purchase price. Saving up this amount may take several years, but it's a worthwhile investment that can pay off significantly in the long run.

What Is an Emergency Fund?

Emergency funds are savings set aside for unexpected financial emergencies. These funds, built up over time from one's income, serve as a safety net during crises.

The importance of emergency funds has been underscored by recent events like the COVID-19 pandemic. Typically, an emergency fund should cover at least one month's worth of expenses. However, some may keep a smaller fund for urgent purchases not covered by their regular accounts.

What Can Emergency Funds Be Used For?

Emergency funds should only be used for true financial emergencies, such as:

- Job loss. To cover living expenses during a period of unemployment.

- Home/auto repairs. To quickly fix damage and maintain living conditions.

- Medical bills. To pay for treatments not fully covered by insurance.

- Funeral costs. To cover unexpected expenses related to a death in the family.

- Urgent travel. For flights to see sick relatives or attend a funeral.

Emergency funds should not be used for discretionary spending, investments, or lending to others.

Why Saving for Both a Down Payment and an Emergency Fund Matters

Saving for a down payment and building an emergency fund at the same time might feel overwhelming, but these two goals actually work together to create long-term financial stability. A down payment helps you move toward homeownership, while an emergency fund ensures that once you’re a homeowner—or even before—you’re protected from financial shocks that could derail your progress.

How These Two Goals Support Each Other

When you save for both simultaneously, you create a balanced financial plan that protects your short-term needs while preparing you for a major long-term goal. Without an emergency fund, any unexpected expense—a job interruption, medical bill, or car repair—can wipe out your down-payment savings or force you into high-interest debt.

Conversely, focusing exclusively on an emergency fund without making progress on your down payment can delay your ability to buy a home, especially as housing prices and interest rates fluctuate.

By dividing your savings across both goals, you ensure:

- You don’t lose momentum toward homeownership. Even modest monthly contributions keep your down-payment fund growing, helping you stay on track with your timeline.

- You’re protected from major financial setbacks. A strong emergency fund acts as a buffer, so surprise expenses don’t knock you off course or force you to take on new debt.

- You build strong financial habits. Saving for two important goals at once requires planning, budgeting, and discipline—skills that will serve you long after you buy a home.

Balancing Your Contributions

Finding the right balance depends on your situation. As a general rule:

- If you have no emergency fund at all, prioritize building at least one month of essential expenses before heavily contributing to your down-payment savings.

- If you have some emergency savings, you can split contributions—such as allocating 60% toward your down payment and 40% toward your emergency fund until both reach your targets.

- If buying a home is an immediate priority, you may shift more aggressively toward the down-payment fund, but it’s still important to keep building a modest emergency buffer.

The goal isn’t perfection—it’s progress. Even small, consistent contributions to both accounts add up over time and create a strong financial foundation for your future.

1. Understanding Your Savings Targets

The first step is to get clear on exactly how much you need to save for a down payment and an emergency fund. These amounts can vary significantly based on your income, location, and financial situation.

How Much Do You Need to Save?

- Down payment. Typically 5-20% of the home's purchase price, depending on the type of mortgage loan. For example, a 20% down payment on a $400,000 home would be $80,000.

- Emergency fund. A common recommendation is 3-6 months' worth of living expenses. This helps cover unexpected costs like medical bills, car repairs, or job loss. The exact amount will depend on your monthly spending.

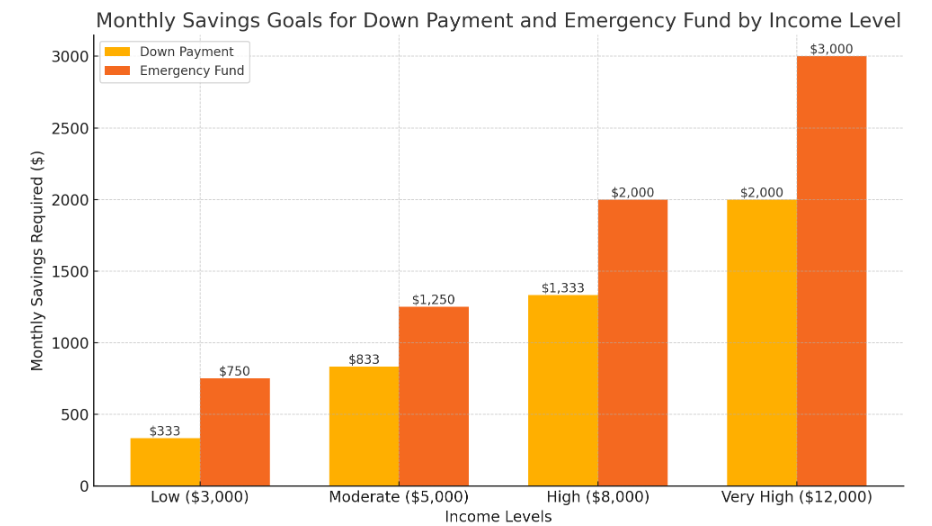

To illustrate the range, let's look at sample savings targets for different income levels and locations:

| Income | Low-Cost Area Emergency Fund | High-Cost Area Emergency Fund |

|---|---|---|

| $50,000 | $12,500 - $25,000 | $18,750 - $37,500 |

| $75,000 | $18,750 - $37,500 | $28,125 - $56,250 |

| $100,000 | $25,000 - $50,000 | $37,500 - $75,000 |

Setting a Timeline for Saving for a Downpayment and Emergency Fund

Once you have a target amount in mind, set a clear timeline for reaching each goal. For most people, saving for a down payment may take 3-5 years, while an emergency fund can often be built within 1-2 years. Breaking down these larger goals into smaller, consistent monthly targets makes them feel much more achievable.

For example, say your down payment target is $80,000 and you want to reach it in 4 years. That works out to saving around $1,667 per month. An emergency fund of $25,000 could be built in 2 years by saving $1,042 per month.

The key is to start small if needed and gradually increase your monthly contributions as your income and budget allow. Slow and steady progress is better than feeling discouraged by overly ambitious goals.

2. Building a Dedicated Savings Strategy

Now that you know your targets, it's time to put a concrete savings plan in place. The most effective approach is to set up separate accounts for your down payment and emergency fund, and then automate regular contributions to each.

Establish Separate Accounts

Having distinct savings accounts for each goal provides clarity and reduces the temptation to dip into one fund for the other. Many online banks offer high-yield savings accounts that earn competitive interest rates, making it easy to keep your money growing.

When you have a dedicated down payment account and emergency fund, it's much easier to track your progress and stay motivated. Plus, having those funds physically separated from your everyday spending account helps prevent accidental withdrawals.

Automate Your Savings

The key to consistent savings is to "pay yourself first" by automatically transferring money into your dedicated accounts. Set up recurring transfers from your checking account so that a portion of each paycheck goes straight into savings before you have a chance to spend it.

Even small, consistent amounts can add up surprisingly fast. For example, saving just $50 per month into a down payment fund and $50 per month into an emergency fund will give you $6,000 in each account after 2 years, plus interest earned. Over time, you can increase these automatic transfers as your budget allows.

Automation takes the willpower out of the equation and makes saving effortless. You'll hardly notice the money leaving your checking account, but you'll be thrilled to see your balances grow.

3. Cutting Down on Non-Essentials

With your savings plan in place, the next step is to review your spending and identify areas where you can trim back. This will free up more money to allocate towards your down payment and emergency fund goals.

Track your expenses. Common monthly budget costs

Audit Your Expenses

Start by carefully reviewing your recent bank and credit card statements. Categorize each expense as either a "need" (essential) or a "want" (non-essential). Look for opportunities to reduce or eliminate discretionary spending on things like dining out, entertainment, subscriptions, and impulse purchases.

For example, a daily $5 coffee habit adds up to $1,825 per year. Cutting back to just 2-3 coffees per week could free up hundreds annually for your savings. Similarly, streaming service subscriptions, gym memberships you don't use, and monthly subscription boxes can all be potential areas to scale back.

Prioritize Needs Over Wants

Once you've identified some spending cuts, be intentional about prioritizing your true needs over discretionary wants. This doesn't mean eliminating all fun and enjoyment from your life - it's about finding the right balance.

When faced with a purchase decision, pause and ask yourself: "Is this a genuine need, or just a want?" If it's a want, see if there's a more affordable alternative. For example, renting movies instead of going to the theater, finding free outdoor activities instead of paid entertainment, or brewing coffee at home instead of buying it daily.

Small adjustments like these can have a big impact on your savings rate without drastically changing your quality of life.

4. Boosting Your Income Streams

In addition to cutting expenses, finding ways to increase your income can also accelerate your progress towards your down payment and emergency fund goals.

Consider Side Gigs or Freelance Work

Explore opportunities to earn extra money through side jobs or freelance work. These can include flexible options like rideshare driving, freelance writing, tutoring, dog walking, or taking on short-term projects in your field of expertise. Even an extra $500-$1,000 per month can make a big difference in your savings timeline.

The beauty of side gigs is that the income is separate from your regular paycheck, so you can allocate 100% of those earnings directly to your savings accounts. Just be mindful not to overcommit and risk burnout.

Related: 25 side gigs that pay weekly

Sell Unused Items

Take a look around your home. Chances are you have various unused items that could be sold for cash. From electronics and furniture to clothing and collectibles, platforms like eBay, Facebook Marketplace, Craigslist, and local buy/sell groups make it easy to declutter and convert your unwanted items into savings.

Not only does this generate extra money, but the act of decluttering can also be quite liberating. As an added bonus, reducing the stuff you own makes it easier to maintain a tidy, organized living space.

5. Choosing the Right Savings Vehicles

When saving for short-term goals like a down payment or emergency fund, it's important to keep your money in accessible, low-risk accounts. This ensures your principal is protected and you can easily withdraw the funds when needed.

High-Yield Savings Accounts and CDs

For your emergency fund, look into high-yield online savings accounts that earn significantly higher interest rates than traditional brick-and-mortar banks. These accounts typically allow you to access your money within a day or two, which is crucial for an emergency fund.

You can also consider certificates of deposit (CDs) for a portion of your emergency savings. CDs typically offer slightly higher interest rates than savings accounts in exchange for locking up your money for a set period, usually 3-12 months. Just be mindful that there may be penalties for early withdrawal.

Investment Accounts for Long-Term Goals

When saving for a down payment that's 3-5 years away, you can consider low-risk investment accounts that have the potential to grow your money faster than a savings account. Good options include bond funds, conservative stock index funds, or target-date funds. Just be sure to maintain a portfolio that aligns with your risk tolerance and time horizon.

The key is striking the right balance between growth potential and liquidity. You don't want to risk losing principal on short-term savings, but longer-term goals like a down payment can benefit from modest investment returns.

Practical Monthly Budgeting Tips

To keep your savings on track, it's essential to have a monthly budgeting system in place. One simple yet effective approach is the 50/30/20 rule.

Implementing the 50/30/20 Rule

This budgeting framework allocates your monthly income as follows:

- 50% for needs (housing, utilities, groceries, etc.)

- 30% for wants (dining out, entertainment, shopping, etc.)

- 20% for saving and debt repayment

For example, if your monthly take-home pay is $5,000, the 50/30/20 rule would look like this:

- $2,500 for needs

- $1,500 for wants

- $1,000 for savings and debt

Adjust the percentages as needed to align with your specific savings goals. You may need to shift more towards the 20% savings portion, perhaps by reducing the "wants" category.

Tracking Your Progress

Regularly monitoring your progress is key to staying motivated. Use a budgeting app, spreadsheet, or old-fashioned pen and paper to track your income, expenses, and savings contributions each month. Visually watching your down payment and emergency fund balances grow will reinforce that your efforts are paying off.

Strategies for Sticking to Your Plan

Saving for long-term goals requires discipline and consistency. Here are some tips to help you stay motivated and on track.

Find an Accountability Partner

Recruit a friend, family member, or colleague to be your savings buddy. Regular check-ins to discuss your progress, challenges, and successes can provide valuable moral support and accountability. You can even set up friendly competitions to see who can hit their monthly targets.

Celebrate Small Wins

Don't wait until you reach your full savings goal to reward yourself. Recognize and celebrate smaller milestones along the way, like hitting 25% of your down payment target or fully funding your emergency savings. This positive reinforcement will keep you motivated and excited about your progress.

Saving on Big Expenses to Boost Funds Faster

In addition to cutting discretionary spending, you can often find significant savings on some of your biggest monthly bills and expenses. Tackling these high-impact areas can supercharge your progress towards your down payment and emergency fund.

Negotiate Bills and Reduce Housing Costs

Contact service providers like internet, cable, and insurance companies to negotiate lower rates. You'd be surprised how often they're willing to offer discounts, especially for loyal customers. Additionally, consider ways to reduce your housing costs, such as taking on a roommate or refinancing your mortgage.

Prioritize Debt Reduction

Before aggressively saving, it's important to focus on paying down any high-interest debts you may have, such as credit cards or personal loans. The interest you save by eliminating this debt can be directly reinvested into your down payment and emergency fund. Tackling high-interest obligations should be a top priority.

Staying Motivated and Focused

Saving for a down payment and emergency fund takes dedication, but the financial security they provide is well worth the effort. By setting realistic goals, automating your savings, cutting expenses, increasing your income, and staying accountable, you can make steady progress towards these important milestones.

Remember, even small, consistent steps add up over time. Stay focused on the big picture, celebrate your achievements along the way, and enjoy the peace of mind that comes with a strong financial foundation.

What To Do If You Don’t Have an Emergency Fund

Now, the above guide provides excellent information on an emergency fund and how to establish one. While your path to a financial cushion may be underway, what should you do if you have to face a financial emergency without a fund today?

Simple Fast Loans offers installment loans to help those who need cash fast. We know how important it is for you to get your money when you need it. No matter your situation, our loans offer a helping hand during dire times.

Simple Fast Loans' Installment Loans

Simple Fast Loans' online installment loans can provide up to $3,000 in cash as quickly as the same day you apply. You can fill out the application online in a few easy steps, and you will find out immediately if you get the loan.

Once you receive your loan amount, you’ll have all the details you need about the monthly installments required to repay your loan.

We will contact you if we have any questions about your application to make sure we are meeting all of your needs correctly.

What You Need To Apply to Simple Fast Loans

You’ll need to access our site online to apply for one of our loans. Make sure you have your government-issued ID and checking account information ready. You should be 18 years of age or older before applying for one of our loans.

On our homepage, select the loan you would like to apply for. Complete the application in as little as a few minutes. We will contact you through your indicated phone number if we have any other questions.

Once your application is submitted, you will receive a decision almost instantly. You will then be informed of the next step in securing your funds. Once they are deposited into your account, you can use them to take control of your financial emergencies with strength and dignity.

Note: The content provided in this article is for informational purposes only. Contact your financial advisor regarding your specific financial situation.