What Is Liquid Net Worth?

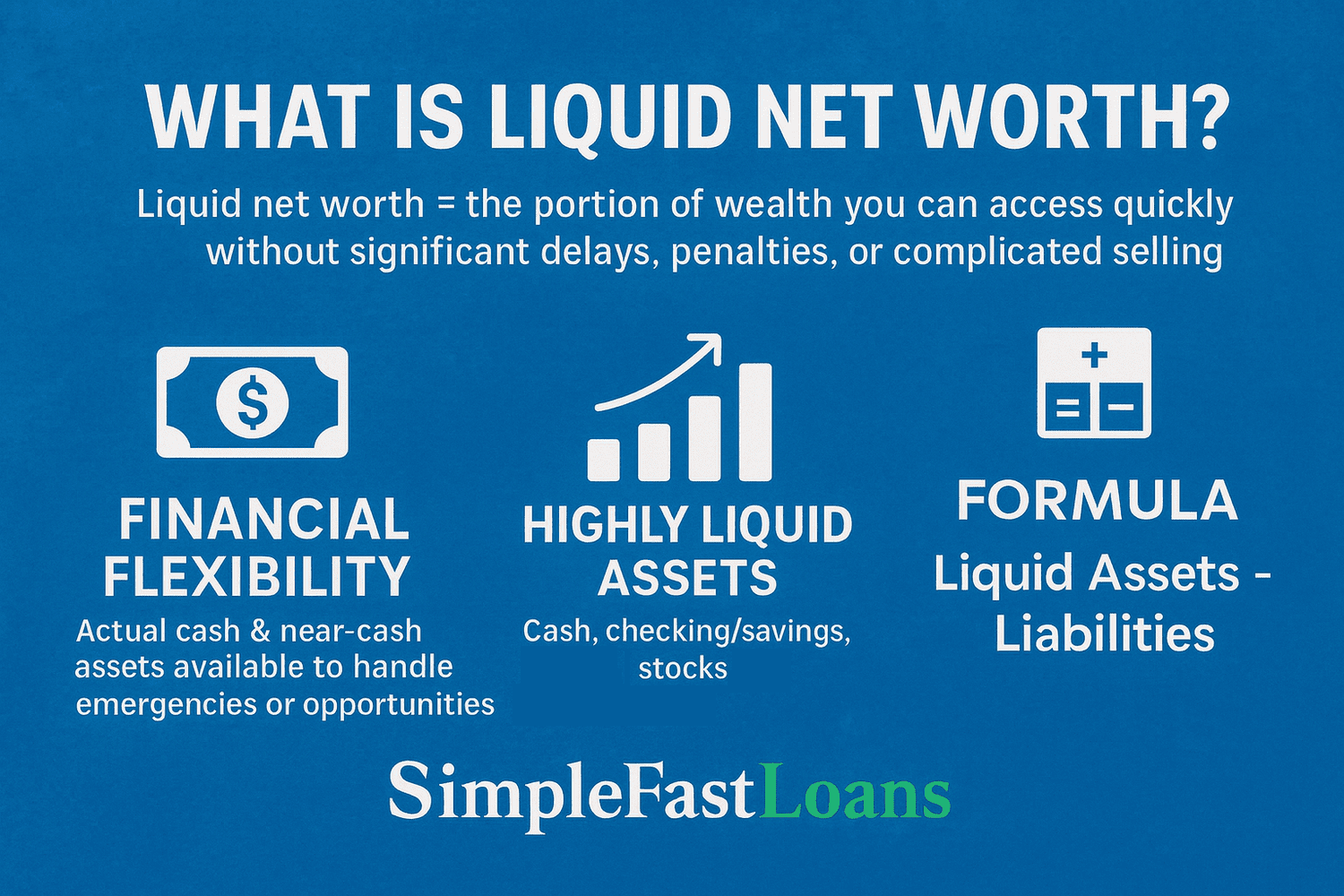

Liquid net worth represents the portion of total wealth that can be accessed quickly without significant delays, penalties, or complicated selling processes. Unlike total net worth, which includes all assets regardless of accessibility, liquid net worth focuses exclusively on readily available financial resources.

This metric reveals true financial flexibility—the actual cash and near-cash assets available to handle emergencies, capitalize on opportunities, or manage unexpected expenses without disrupting long-term financial plans.

Consider this scenario: A homeowner with $500,000 in real estate equity, $75,000 in retirement accounts, and $15,000 in savings might appear financially secure. However, when facing an urgent medical expense, only the savings account (and potentially some liquid investments) provides immediate relief. Now let's get into more detailed scenarios below.

Key Takeaways

- Liquid net worth = true financial flexibility – it measures the portion of wealth you can access quickly, unlike total net worth, which includes illiquid assets like homes or retirement accounts.

- Highly liquid assets include cash, checking/savings accounts, stocks, and short-term investments — while real estate, retirement funds, and collectibles are excluded due to delays, penalties, or limited marketability.

- Why it matters – liquid net worth determines how well you can handle emergencies, seize opportunities, or secure loans without disrupting long-term financial plans.

- Formula is simple: Liquid Net Worth = Liquid Assets – Liabilities. This gives a clear picture of your actual accessible wealth.

- Boosting liquid net worth requires a strategy – build an emergency fund, reduce high-interest debt, balance investments for liquidity, and use high-yield savings products to grow accessible cash faster.

What Is Liquid Net Worth?

Liquid net worth is the portion of your overall net worth that you can access quickly—without waiting, paying heavy penalties, or selling hard-to-liquidate assets. In simple terms, it’s the money and assets you could turn into cash within days or weeks to cover emergencies, opportunities, or unexpected expenses.

For example, while your home adds value to your net worth, selling it to access cash is time-consuming and costly. Liquid net worth strips away those illiquid assets to reveal what you truly have available at short notice.

What Assets Count as Liquid?

Curious about the assets that count as "liquid," let's dive in.

Highly Liquid Assets

- Cash holdings: Checking accounts, savings accounts, and money market accounts

- Marketable securities: Publicly traded stocks, bonds, ETFs, and mutual funds

- Cash equivalents: Treasury bills, short-term CDs (under 12 months), and high-yield savings products

Moderately Liquid Assets

- Longer-term CDs: May include early withdrawal penalties

- Precious metals: Gold, silver (if actively traded markets exist)

- Some corporate bonds: Depending on market conditions

Non-Liquid Assets (Excluded)

- Real estate properties

- Retirement accounts (401(k), IRA with penalty restrictions)

- Vehicles and equipment

- Collectibles and artwork

- Business ownership stakes

- Whole life insurance cash value

See the chart below for a summary:

| Highly Liquid Assets | Moderately Liquid Assets | Non-Liquid Assets (Excluded) |

|---|---|---|

| Cash holdings (Checking, savings, money market) | Longer-term CDs (may have penalties) | Real estate properties |

| Marketable securities (Stocks, bonds, ETFs, mutual funds) | Precious metals (gold, silver in active markets) | Retirement accounts (401k, IRA with penalties) |

| Cash equivalents (T-bills, short-term CDs <12mo, HY savings) | Some corporate bonds | Vehicles and equipment |

| Collectibles & artwork | ||

| Business ownership stakes | ||

| Whole life insurance cash value |

Liquid Net Worth vs. Total Net Worth

Total net worth provides a comprehensive snapshot of financial position by calculating all assets minus all liabilities. Liquid net worth narrows this calculation to immediately accessible wealth.

- Total Net Worth Formula: All Assets - All Liabilities = Total Net Worth

- Liquid Net Worth Formula: Liquid Assets - Liabilities = Liquid Net Worth

Take a Look at a Real-World Example

Let's test our understanding by looking at some real-world information.

Sarah's Financial Position:

- Home value: $400,000

- 401(k) balance: $85,000

- Checking account: $12,000

- Stock portfolio: $35,000

- High-yield savings: $18,000

- Credit card debt: $8,000

- Mortgage balance: $280,000

Total Net Worth: $262,000 Liquid Net Worth: $57,000 ($12,000 + $35,000 + $18,000 - $8,000)

Why Liquid Net Worth Matters More Than You Think

Here's why your liquid net worth is important:

Financial Emergency Preparedness

Unexpected events including medical emergencies, job loss, and major repairs require immediate financial response. Liquid net worth determines actual emergency preparedness, not theoretical wealth tied up in illiquid assets.

Related: How much cash should you keep on hand?

Investment Opportunity Readiness

Market downturns, real estate deals, or business opportunities often require quick capital deployment. Higher liquid net worth enables strategic financial moves without forced asset sales at unfavorable times.

Stress Reduction and Peace of Mind

Knowing exactly how much readily available money exists reduces financial anxiety and enables better long-term decision-making without panic-driven choices.

Lending and Credit Advantages

Financial institutions evaluate liquid net worth when making lending decisions. Higher liquidity often translates to better loan terms and increased borrowing capacity.

How to Calculate Your Liquid Net Worth

Use the steps below to find your liquid net worth:

Step 1: Identify All Liquid Assets

Create a comprehensive list including:

- All bank account balances

- Investment account values (excluding retirement accounts)

- Cash equivalents and short-term investments

Step 2: Calculate Total Liabilities

Include all debts:

- Credit card balances

- Personal loans

- Student loans

- Car loans

- Any other outstanding debts

Step 3: Apply the Formula

Liquid Net Worth = Total Liquid Assets - Total Liabilities

How to Increase Your Liquid Net Worth

Are you not happy with your number? Well, here are some strategies to crank it up.

1. Establish a Robust Emergency Fund

For an emergency fund, financial experts recommend maintaining 3-6 months of living expenses in highly liquid accounts. This foundation prevents forced liquidation of investments during temporary setbacks.

Action Steps:

- Calculate monthly essential expenses

- Multiply by the desired months of coverage

- Gradually build a fund in a high-yield savings account

2. Optimize Investment Allocation

Balance growth potential with liquidity needs by maintaining a portion of investments in easily sellable securities.

Strategic Approach:

- Keep 10-20% of investment portfolio in highly liquid assets

- Focus on blue-chip stocks and established ETFs

- Avoid over-concentration in illiquid investments

3. Accelerate High-Interest Debt Elimination

Every dollar paid toward high-interest debt increases net worth while reducing ongoing cash drains.

Prioritization Method:

- List all debts by interest rate

- Target the highest-rate debts first

- Maintain minimum payments on other obligations

4. Maximize Savings Rate Through Expense Optimization

Systematic expense reduction directly increases available cash for liquid asset accumulation.

Proven Techniques:

- Audit recurring subscriptions and memberships

- Negotiate better rates on insurance and utilities

- Implement a zero-based budgeting approach

5. Leverage High-Yield Financial Products

Take advantage of promotional rates and competitive yields to accelerate liquid wealth growth.

Opportunities:

- High-yield savings accounts with promotional APY boosts

- Short-term CDs with favorable rates

- Money market accounts with tiered interest rates

Liquid Net Worth Benchmarks by Age

Understanding typical liquid net worth ranges helps gauge financial progress, though individual circumstances vary significantly.

Ages 25-34: Building Foundation

- Typical Range: $5,000 - $25,000

- Focus: Emergency fund establishment, debt reduction

- Challenges: Student loans, lower income levels

Ages 35-44: Acceleration Phase

- Typical Range: $25,000 - $100,000

- Focus: Investment growth, family financial security

- Opportunities: Peak earning potential beginning

Ages 45-54: Wealth Accumulation

- Typical Range: $100,000 - $250,000

- Focus: Retirement preparation, asset diversification

- Advantages: Established careers, reduced debt burdens

Ages 55+: Pre-Retirement and Beyond

- Typical Range: $250,000+

- Focus: Capital preservation, income generation

- Considerations: Increased liquidity needs for healthcare

Note: These ranges reflect general patterns and individual situations may vary dramatically based on income, geographic location, and financial choices.

Common Liquid Net Worth Mistakes to Avoid

Here are mistakes to avoid when trying to create more liquidity.

Over-Investing in Illiquid Assets

While real estate and retirement accounts are valuable, excessive concentration leaves individuals financially inflexible during emergencies.

Ignoring Opportunity Costs

Keeping too much money in low-yield savings accounts may preserve liquidity but sacrifices long-term growth potential.

Underestimating Liquidity Needs

Failing to account for potential job loss duration or major emergency expenses can leave individuals financially vulnerable.

Neglecting Regular Reassessment

Financial circumstances change; liquid net worth calculations should be updated regularly to reflect current reality.

Your Next Steps

Building substantial liquid net worth requires a systematic approach and consistent execution. Start by calculating current liquid net worth, then implement one strategy at a time rather than attempting wholesale financial changes.

Remember that liquid net worth serves as financial insurance that provides security, opportunity, and peace of mind that makes all other wealth-building activities more sustainable and less stressful.

The goal isn't just accumulating liquid assets, but creating a foundation that supports confident long-term financial decision making while maintaining flexibility for life's inevitable surprises.

Related Frequently Asked Questions (FAQs)

Here are questions people often ask about liquid net worth.

Should 401(k) loans be considered when calculating liquid net worth?

Generally no. While 401(k) loans provide access to retirement funds, they come with restrictions, repayment requirements, and potential career change complications that make them unreliable for true liquidity needs.

How does liquid net worth differ for business owners?

Business owners should be particularly careful about liquidity since business assets are typically illiquid. They may need higher liquid net worth ratios to compensate for income volatility.

What percentage of total net worth should be liquid?

Most financial advisors recommend 10-30% of total net worth remain liquid, though this varies based on age, career stability, and personal circumstances.

How often should liquid net worth be recalculated?

Monthly tracking provides an optimal balance between staying informed and avoiding obsessive monitoring. Quarterly reviews work well for less active investors.