How To Get Instantly Approved for an Auto Repair Loan with Bad Credit

Car repairs can be quite expensive, ranging from $200 to $2,000 on average. Unfortunately, many car owners tend to ignore regular maintenance due to the time and money it requires. This neglect can lead to breakdowns, which end up costing more towards the higher end of the price range.

It's crucial to be prepared for such emergency costs, but over half of Americans wouldn't be able to cover even a $1,000 bill with their savings. If you heavily rely on your car and can't afford the repair costs, you may want to consider applying for a car repair loan.

What Is an Auto Repair Loan?

Even if your car is insured, you would, most likely, have to take care of the repairs from general wear and tear yourself.

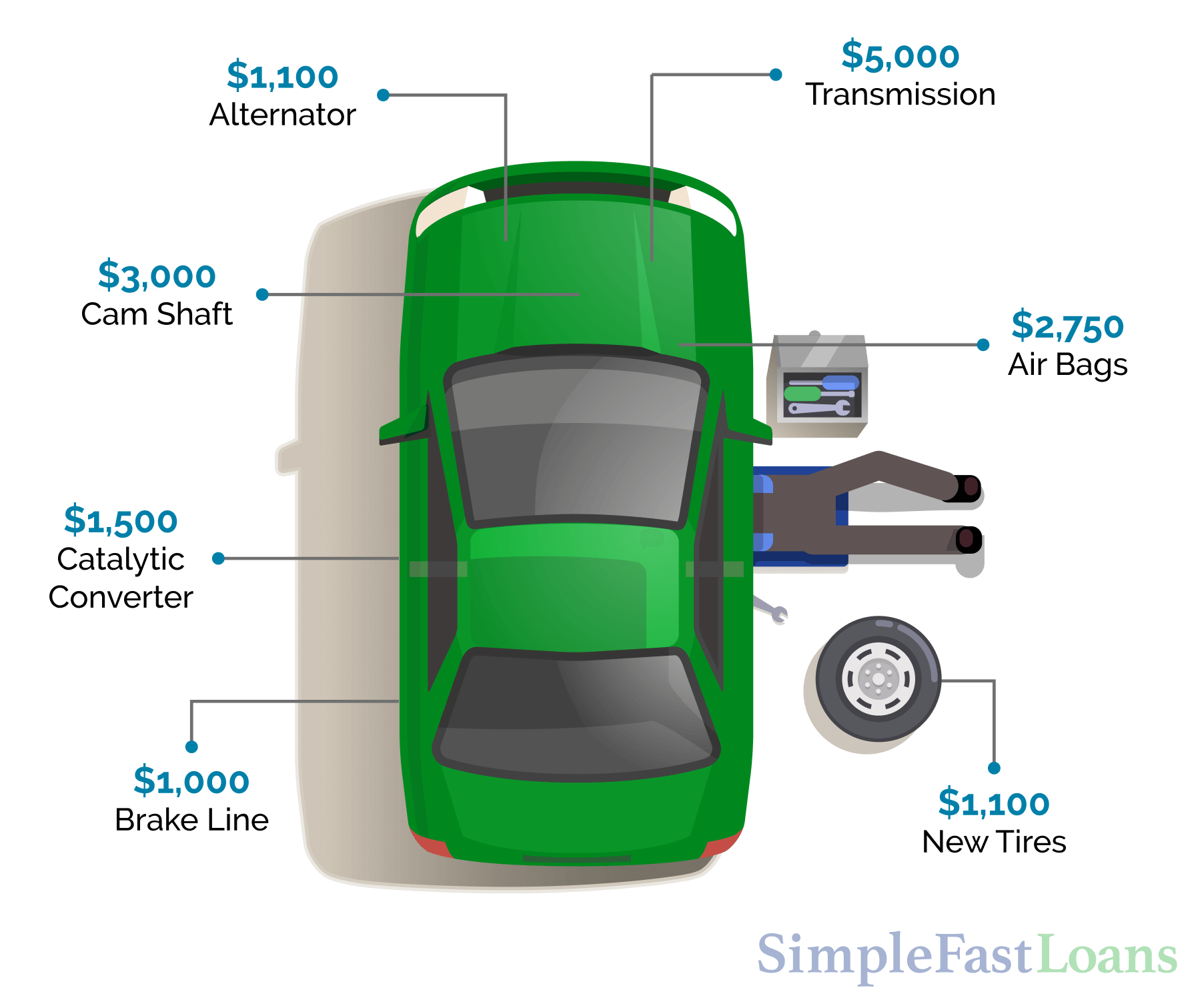

Borrowers can take advantage of an auto repair loan if they need to get tires replaced, brakes repaired, or even something major like a powertrain refurbished.

Typically, a loan can be considered an "auto repair loan" if the money is being used to cover car repairs. Personal loans can be an example of auto repair loans.

In fact, they are among the most common types of loans used for such purposes as they offer quite a few important benefits:

- Personal loans can be unsecured which means that a form of collateral wouldn’t be required. That’s a good option for those who do not have valuable assets (except for their car which is not functioning at the moment).

- If you get approved, you will receive the whole sum at once. This means that you will get to repair the car in the shortest timeframe and continue using the vehicle for your personal needs.

- You will get the money fast. Once the personal loan gets approved, you will typically receive the money in 3-7 days. However, with some lenders, you might be able to get the sum that you urgently need in only a day. With Simple Fast Loans, for example, the loan can get funded by the end of the next business day or even the same day if the loan gets signed before 2:00 PM Eastern Standard Time.

- It would be easy for you to manage the repayment of the loan as you would typically have to make equal monthly payments throughout a certain period that you have agreed on with the lender. Knowing the exact date when you have to make the payment will help you manage your finances without having to deny yourself the lifestyle that you’re used to.

There are plenty of different lenders that offer auto repair loans. Credit unions, banks, and online lenders, but the only downside is that the majority of lenders would require you to have good or excellent credit. Otherwise, you simply wouldn’t get approved for the loan.

The good news is that there are online lenders that are ready to consider any credit score. Lenders like Simple Fast Loans are designed to help those needing an auto loan with bad credit.

How To Get Instantly Approved for an Auto Repair Loan with Bad Credit

If you depend on your car, then getting it repaired as soon as possible will become your top priority. Applying for a personal loan usually involves gathering plenty of documents, traveling to the loan office, signing some papers, and then waiting for the lender to make a decision (this can take a week or even longer).

Thankfully, you wouldn't have to go through all of that, if you elect to go with Simple Fast Loans. The friendly company representatives are well-aware that you need to receive the money in the shortest timeframe. So, they will try to do everything they can to make that happen.

And the best part is that you’ll get to apply for the loan from the comfort of your own home. All you would have to do is:

- Fill out the application form online. In case you want to fund your car repairs with a personal loan, you would have to provide your ID, address, email, and name, as well as your active checking account.

- You would also have to provide your Social Security number and income statements (for example, recent paycheck stubs). Do bear in mind that if you experience any difficulties during the application process, you can always call the company directly and they will guide you through the whole process and answer all of your questions.

- After you have provided all the necessary information, the company representative will set up your loan agreement.

- Very soon you will be provided with an online loan package that needs to be signed. By the way, you wouldn’t have to print out any agreements to sign them. All that can be done directly on the lender’s website or through a link that will be sent to your email.

- To e-sign the documents, you would have to follow the simple instructions that you’ll notice on the left side of the screen. In a nutshell, all you would have to do is click in the rights spots of the agreement where your signature is required.

- Once you have signed all the necessary documents, you are done! You will receive a text once your loan gets funded. By the way, the earlier in the day you apply for the loan, the higher the chances that you will receive the funds the same day.

- Use the money to cover your emergency expenses and then begin paying the sum back in equal monthly payments. You can always check your account balance by selecting ‘My Account’ on the website.

What Documents Do I Need To Apply?

Usually, the lender will consider the following factors when making a decision:

- Credit history

- Debt-to-income ratio (the percentage of your monthly income that will be used to pay your monthly debt)

- Income information

Though the representative of Simple Fast Loans will check your credit (with an alternative credit bureau), it won’t become the main factor that determines whether you’ll get approved for the loan or not. In fact, you may get approved even with bad credit, as long as you provide proof of income.

All the information that you will provide will be verified electronically. This includes your identity, your bank account information, and your income. Once you provide all the documentation needed, you may get approved for anywhere between $200 and $3,000, in case you’re applying for a personal loan.

If you have prepared all the necessary documents beforehand, the whole application process might take you as little as a few minutes. Here is what you’re going to need:

- Your passport or driver’s license. You should bear in mind that you have to be over 18 to apply for a loan.

- Your routing and account number for the active checking account in your name.

- Your Social Security number (you can find it on tax documents and bank statements or your Social Security card). If you need to obtain an SSN for the first time, you will need to apply for one of the Social Security offices. If you have lost your SSN card, you might not need a replacement as simply knowing the number is enough

- Income statements (pay stubs, ideally, covering 3 months in a row). You can also provide a divorce decree, child support award, and any other documents containing income information

You wouldn’t have to provide any type of collateral, so the documents mentioned above are the only ones that you’re going to need.

Get Approved for an Auto Repair Loan Today!

Simple Fast Loans is a nationally-recognized company that offers online personal loans in 26 states. The fully-licensed company prioritizes customer satisfaction and the quality of customer service. Car breakdowns practically always happen unexpectedly. And more often than not, the repairs do require quite a sum that you might not have readily available.

A personal loan may be used to help you fund the necessary auto repairs. Simple Fast Loans can help you get the money that you need in the shortest timeframe without even having to leave your house. Complete a short online form and get a loan decision instantly — simple as that!