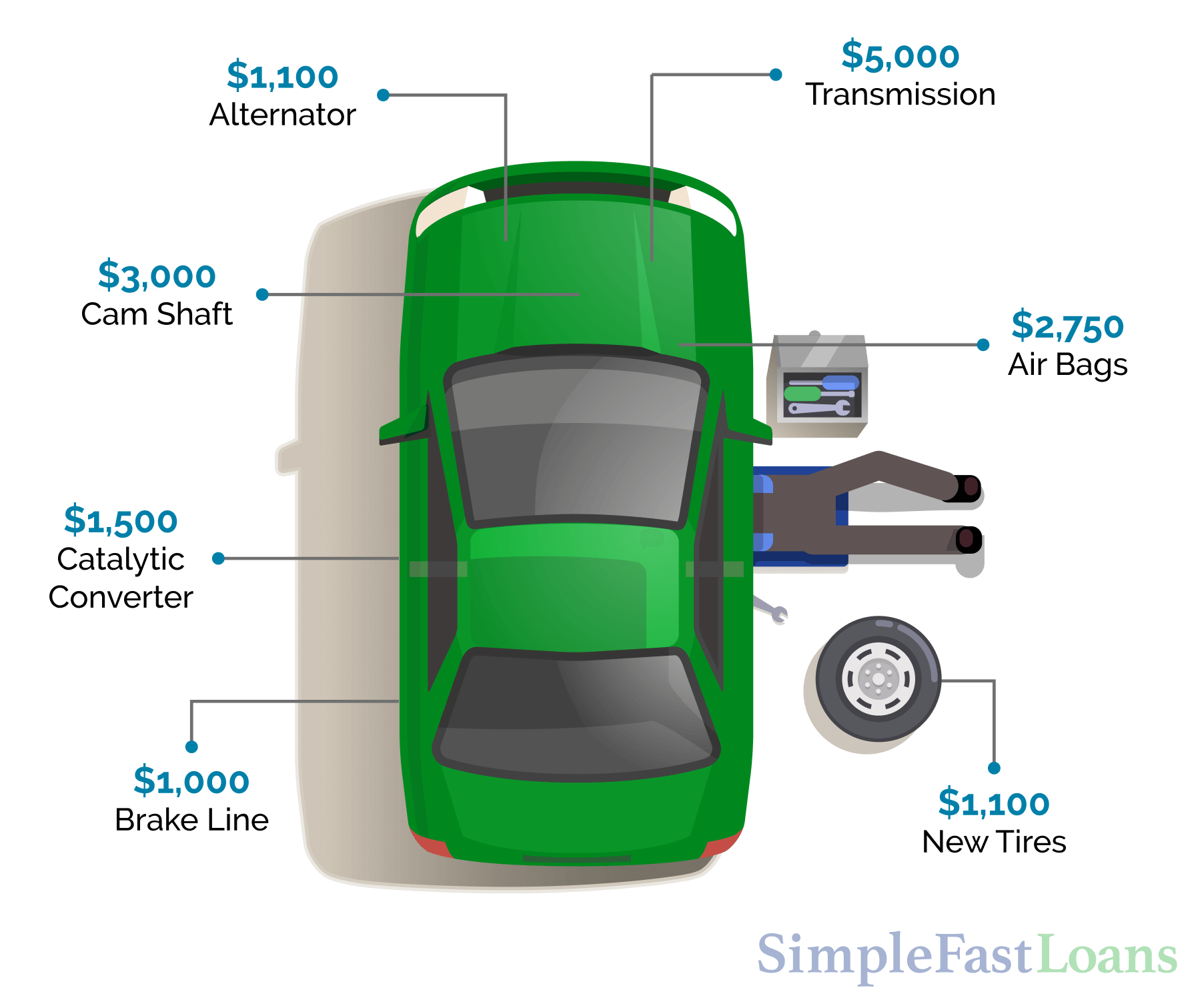

Car repairs can be quite expensive, ranging from $200 to $2,000 on average. Unfortunately, many car owners tend to ignore regular maintenance due to the time and money it requires. This neglect can lead to breakdowns, which end up costing more towards the higher end of the price range.

It's crucial to be prepared for such emergency costs, but over half of Americans wouldn't be able to cover even a $1,000 bill with their savings. If you heavily rely on your car and can't afford the repair costs, you may want to consider applying for a car repair loan.

Even if your car is insured, you would, most likely, have to take care of the repairs from general wear and tear yourself.

Borrowers can take advantage of an auto repair loan if they need to get tires replaced, brakes repaired, or even something major like a powertrain refurbished.

Typically, a loan can be considered an "auto repair loan" if the money is being used to cover car repairs. Personal loans can be an example of auto repair loans.

In fact, they are among the most common types of loans used for such purposes as they offer quite a few important benefits:

There are plenty of different lenders that offer auto repair loans. Credit unions, banks, and online lenders, but the only downside is that the majority of lenders would require you to have good or excellent credit. Otherwise, you simply wouldn’t get approved for the loan.

The good news is that there are online lenders that are ready to consider any credit score. Lenders like Simple Fast Loans are designed to help those needing an auto loan with bad credit.

If you depend on your car, then getting it repaired as soon as possible will become your top priority. Applying for a personal loan usually involves gathering plenty of documents, traveling to the loan office, signing some papers, and then waiting for the lender to make a decision (this can take a week or even longer).

Thankfully, you wouldn't have to go through all of that, if you elect to go with Simple Fast Loans. The friendly company representatives are well-aware that you need to receive the money in the shortest timeframe. So, they will try to do everything they can to make that happen.

And the best part is that you’ll get to apply for the loan from the comfort of your own home. All you would have to do is:

Usually, the lender will consider the following factors when making a decision:

Though the representative of Simple Fast Loans will check your credit (with an alternative credit bureau), it won’t become the main factor that is going to determine whether you’ll get approved for the loan or not. In fact, you may get approved even with bad credit, as long as you provide proof of income.

All the information that you will provide will be verified electronically. This includes your identity, your bank account information, and your income. Once you provide all the documentation needed, you may get approved for anywhere between $200 and $3,000, in case you’re applying for a personal or personal loan.

If you have prepared all the necessary documents beforehand, the whole application process might take you as little as a few minutes. Here is what you’re going to need:

You wouldn’t have to provide any type of collateral, so the documents mentioned above are the only ones that you’re going to need.

Simple Fast Loans is a nationally-recognized company that offers online personal loans in 26 states. The fully-licensed company prioritizes customer satisfaction and the quality of customer service. Car breakdowns practically always happen unexpectedly. And more often than not, the repairs do require quite a sum that you might not have readily available.

A personal loan may be used to help you fund the necessary auto repairs. Simple Fast Loans can help you get the money that you need in the shortest timeframe without even having to leave your house. Complete a short online form and get a loan decision instantly — simple as that!

Browse through the Blog to read articles and tips on managing debt, improving your credit and saving more money!